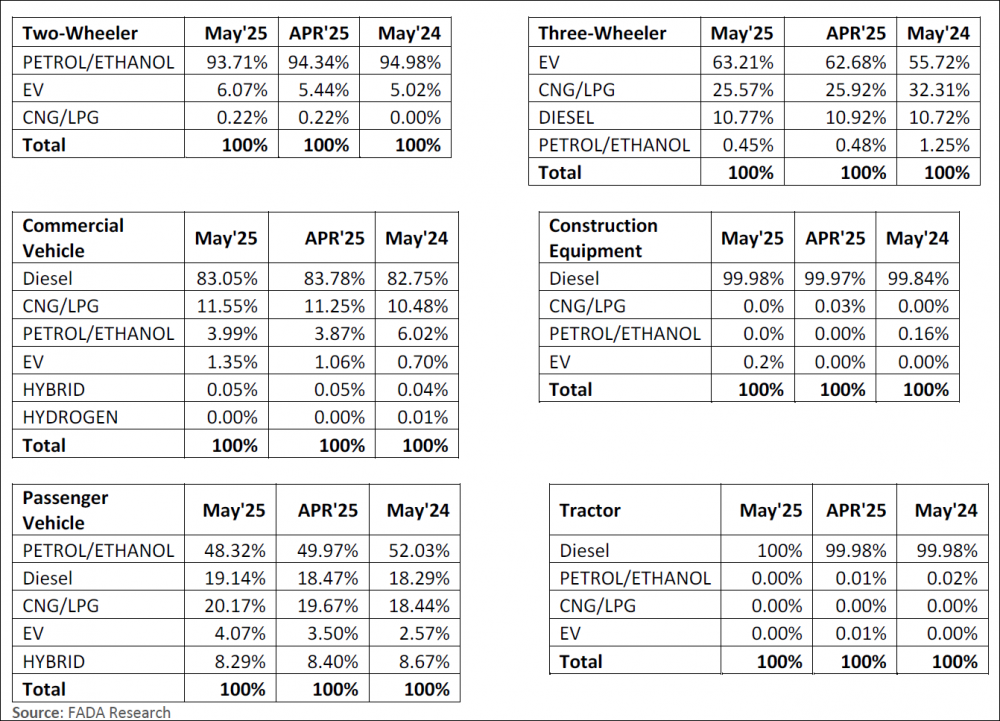

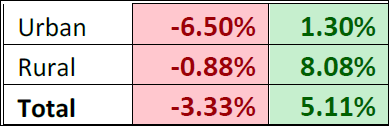

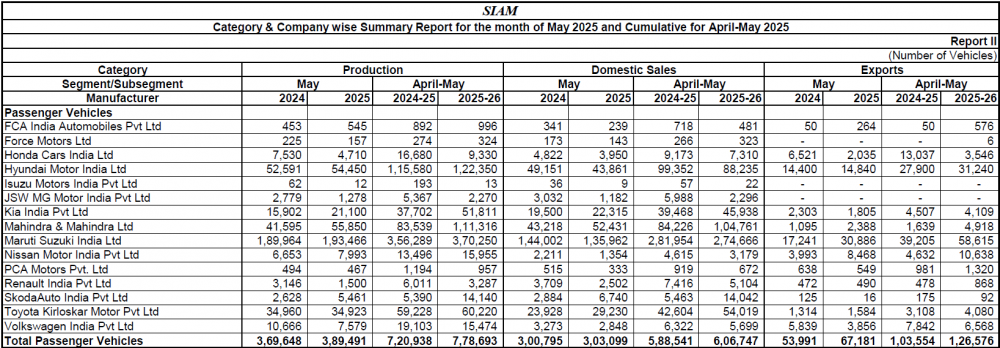

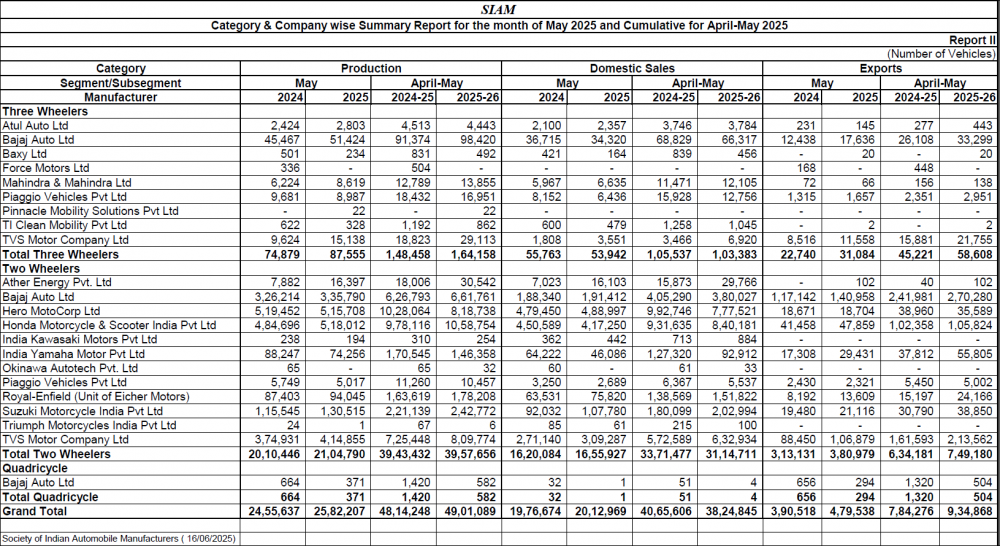

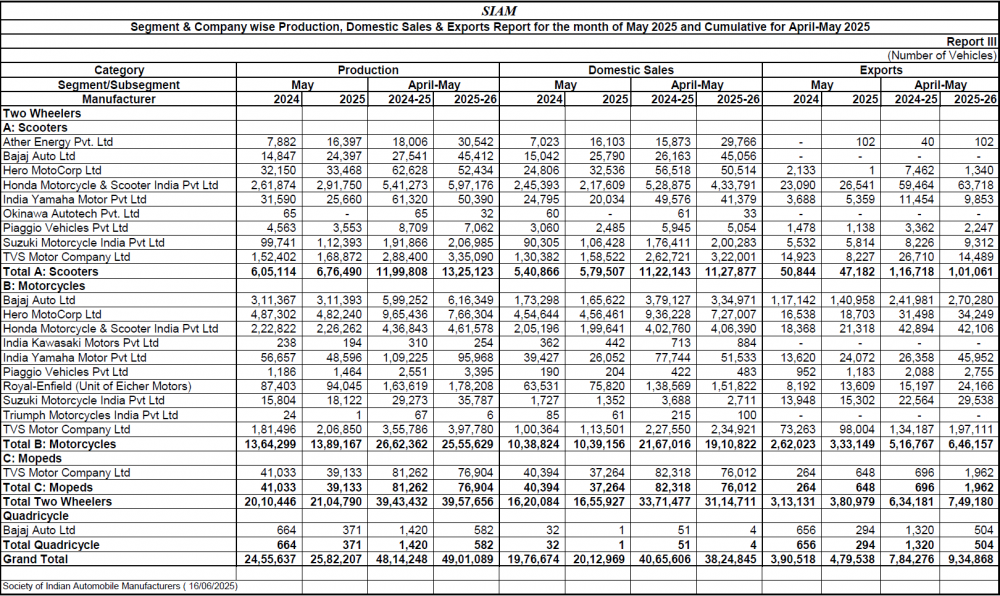

The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for May'25. May’25 Retails Reflecting on May 2025 Auto Retail results, FADA President Mr. C S Vigneshwar said: “The month of May registered a modest 5% YoY growth overall. Segment-wise, 2W, 3W, and Trac led the way with gains of 7.3%, 6.2%, and 2.7% respectively, while PV, CE, and CV declined by 3.1%, 6.3%, and 3.7%. In the 2W category, retail volumes fell 2.02% MoM but still posted a robust 7.31% YoY increase. Dealers attribute this resilience to a higher number of auspicious marriage days, a strong Rabi harvest, and pre-monsoon demand— especially in semi-urban and rural markets. That said, financing constraints in the economy segment capped full upside potential. Looking ahead, stakeholders should continue to monitor liquidity access and model availability to preserve momentum.

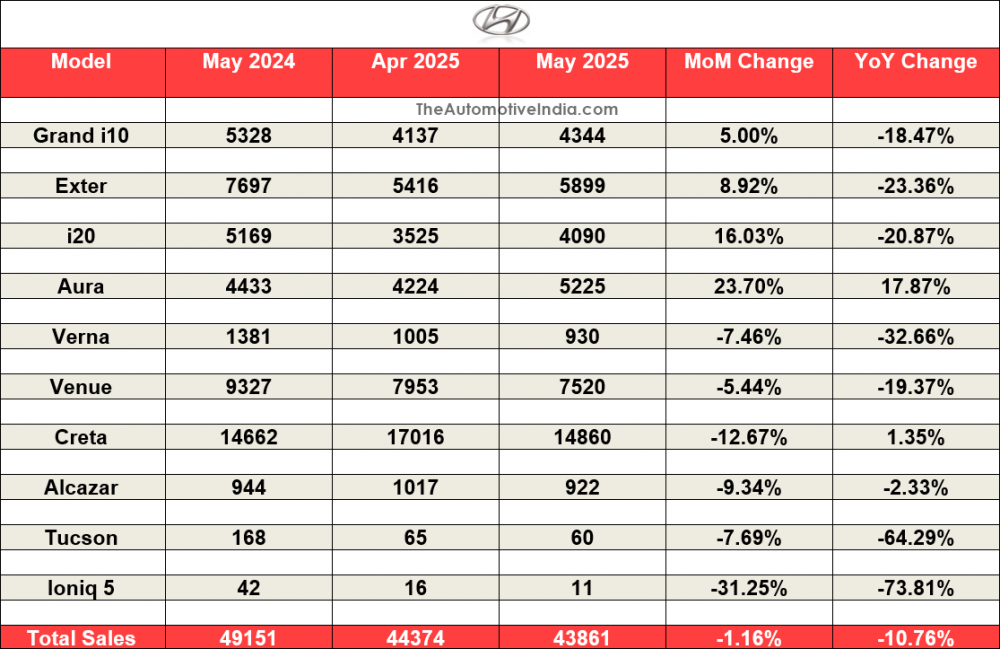

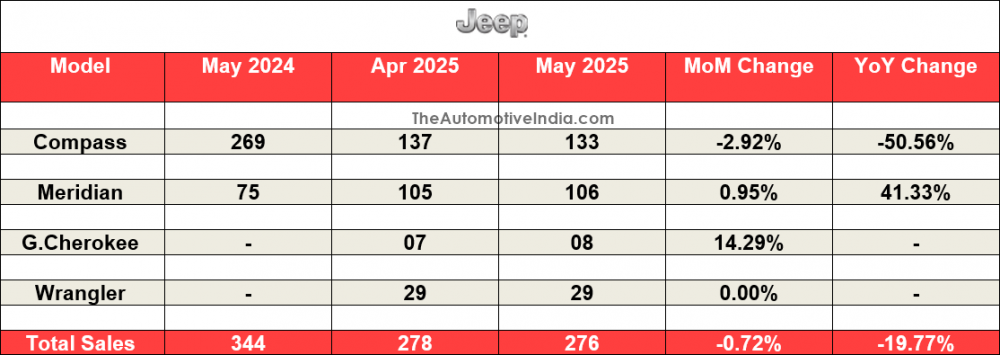

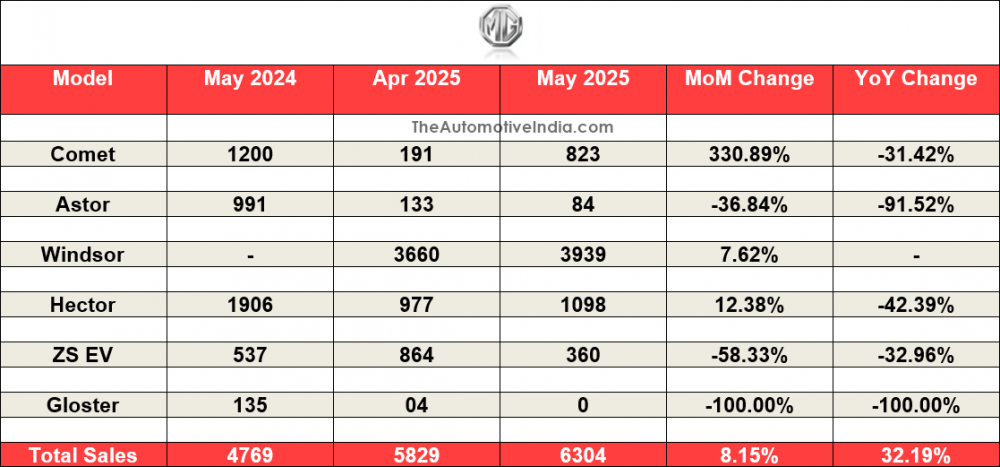

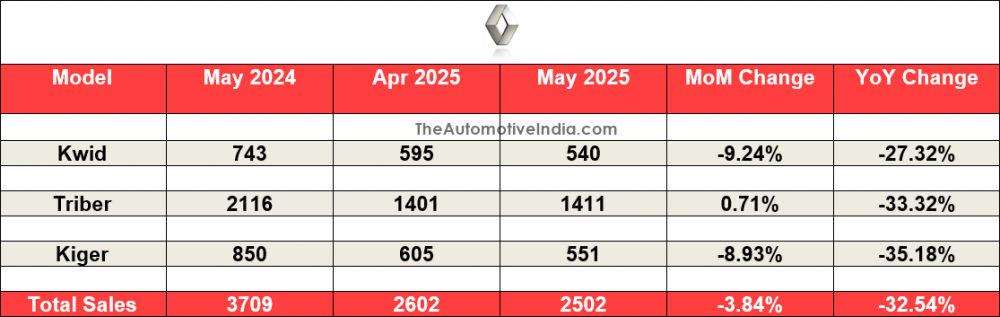

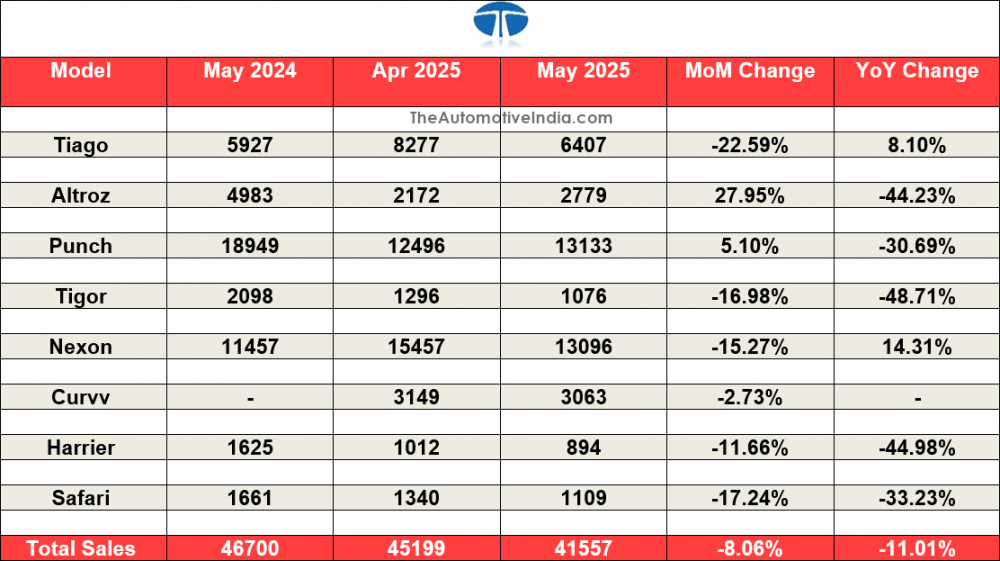

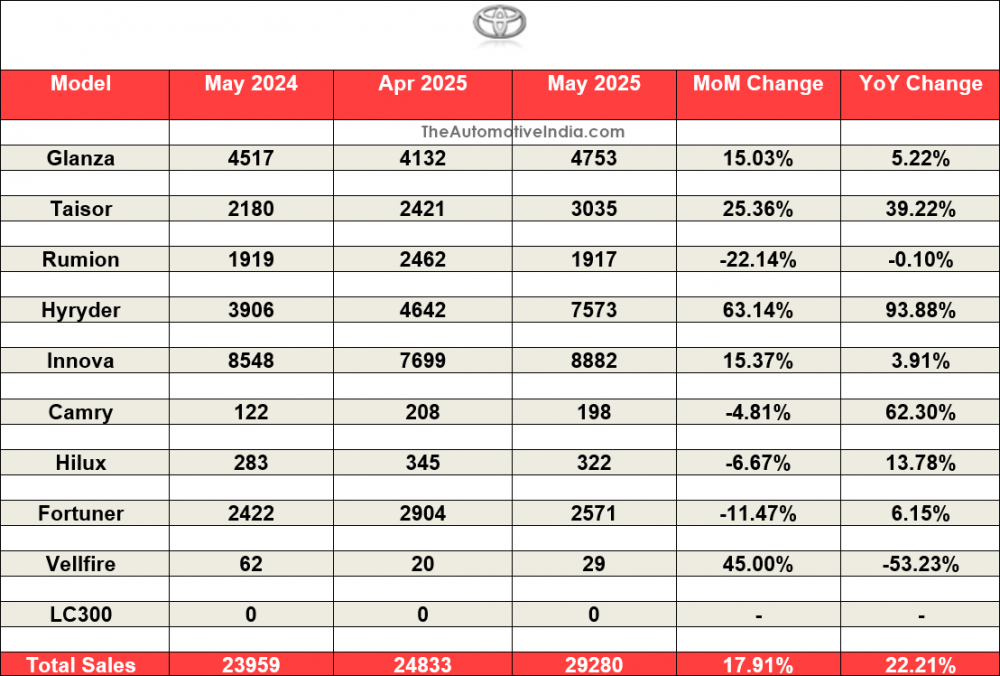

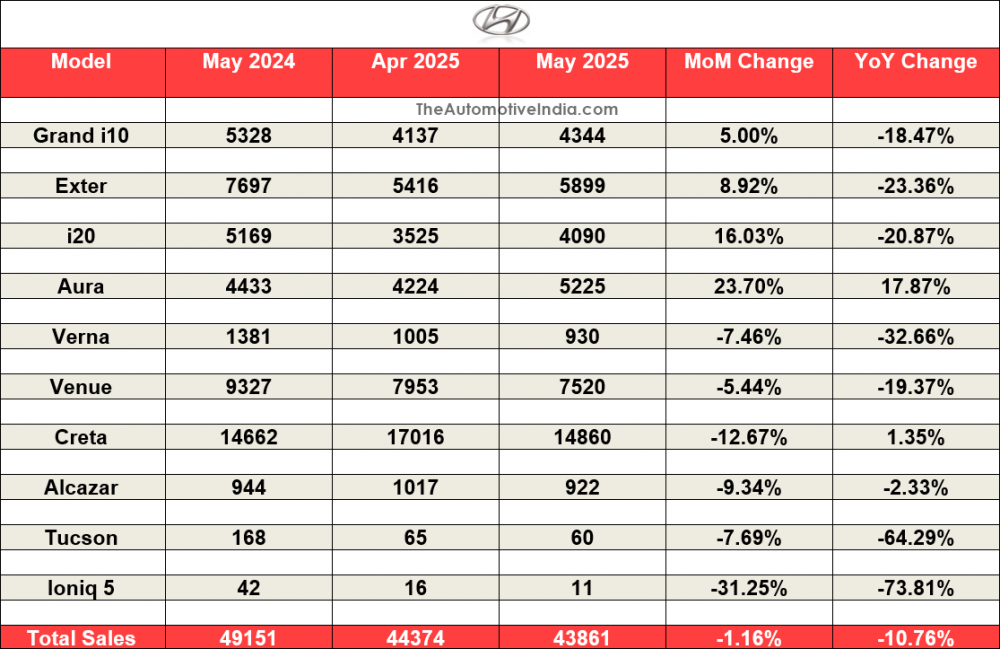

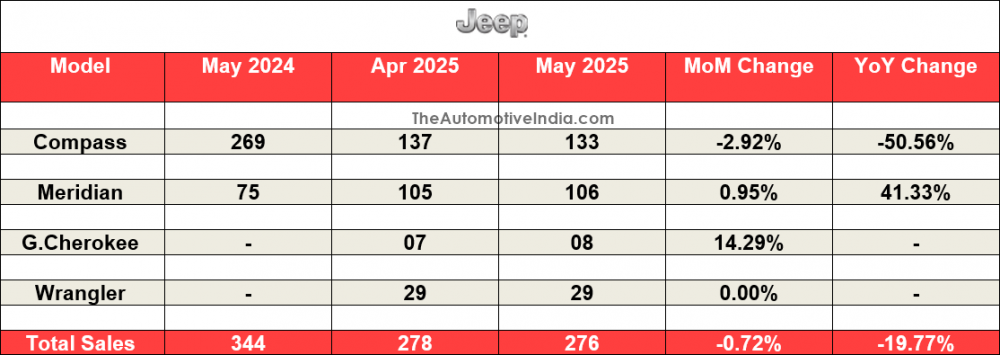

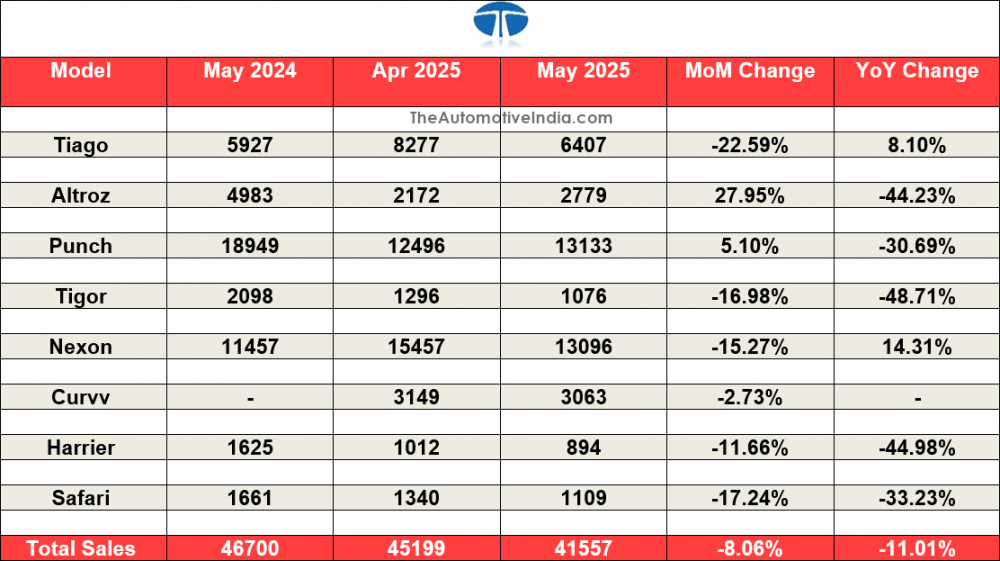

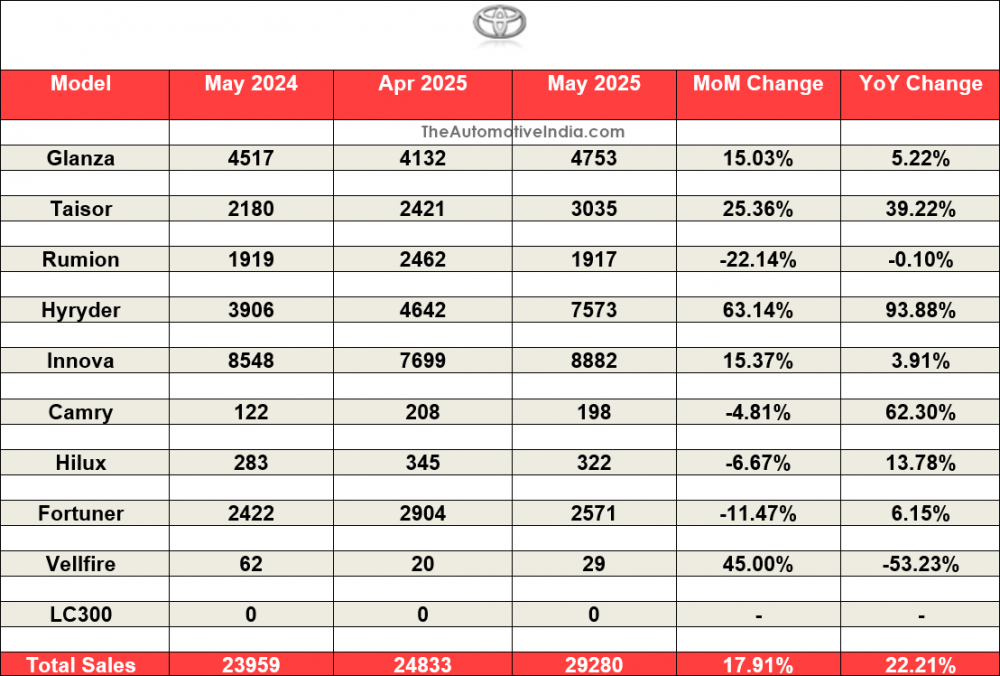

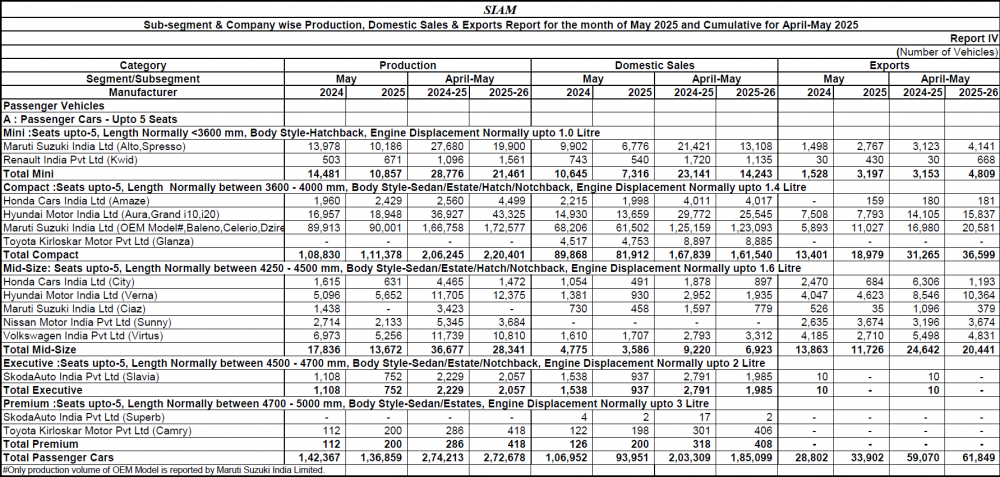

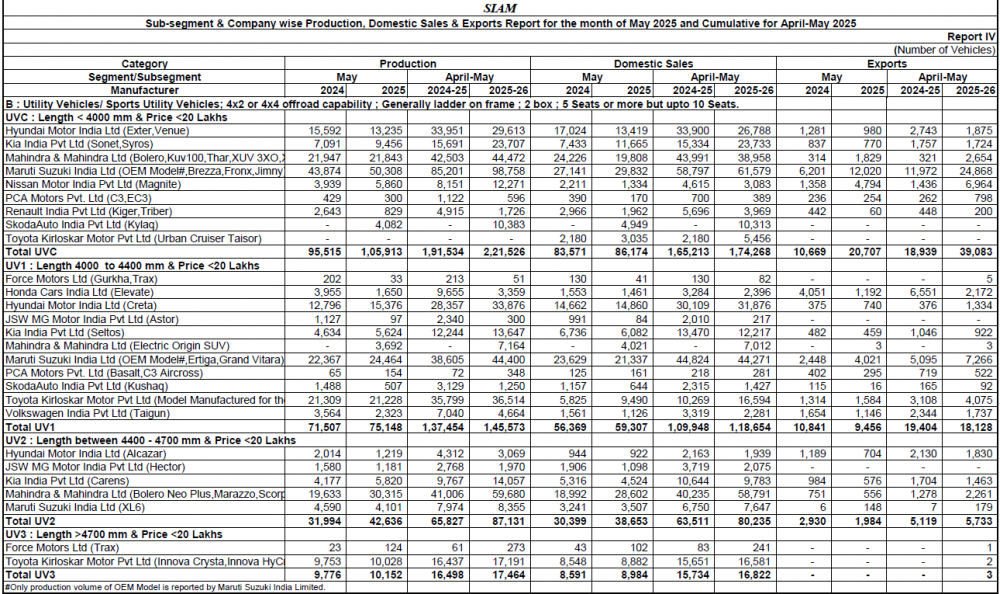

Passenger-vehicle retails contracted by 13.6% MoM and 3.1% YoY, while inventory days—which had hovered around 50—have edged up to approximately 52–53 days. Entry-level models were hardest hit as constrained financing and subdued consumer sentiment compounded the slowdown. Heightened war related tensions for border tensions like Jammu & Kashmir, Punjab, Rajasthan, and Gujarat further prompted buyers to delay purchases. Although bookings remained fairly healthy, retail conversions lagged on margin-money challenges and deferred decisions. OEMs must adopt a cautious, ground-reality-aligned approach to production planning and channel incentives so that dealers are not burdened by rising carrying costs or forced into excessive discounting. Commercial-vehicle retails declined by 11.25% MoM and 3.71% YoY amid muted freight cycles, tight liquidity, and adverse geopolitical sentiment. While bus sales offered some relief, passenger carriers and commodity-linked segments (cement, coal) saw sharp de-growth due to delayed financing and softening TIV. Wholesales, however, accelerated as OEMs and Dealers built inventory ahead of the June 2025 mandatory A/C driver-cabin regulation.”

Near-Term Outlook

India’s economic foundations remain robust as Q4 FY25 GDP sustains near 6.5% growth and consumer-price inflation trends toward the RBI’s 4% target. The India Meteorological Department’s revised forecast—monsoon rains at 106% of the long-period average—signals renewed rural liquidity and stronger farm incomes, which should bolster semi-urban and hinterland demand for two-wheelers and tractors. Concurrently, a widely anticipated 25 bp repo-rate reduction in early June will continue to ease borrowing costs for both dealerships and end customers, while recent fiscal measures—such as the 3% MSP hike on kharif crops—are poised to amplify agricultural cash flows. However, global supply-chain headwinds—from rare-earth constraints in EV components to ongoing geopolitical tensions—may keep urban consumer sentiment in check. In our June survey, 55.46% of members expect flat volumes, 31% foresee growth, and 13.54% anticipate de-growth, underscoring a cautiously balanced demand outlook for the coming month.

Channel dynamics for June reflect this cautious optimism: monsoon-driven rural traction and festival pull-through should sustain 2W activity, yet persistent financing constraints and selective OEM price adjustments may temper incremental gains. PV dealers report elevated inventory days and legacy product portfolios, limiting retail conversions despite localized Rath Yatra uplifts. In the CV segment, inventory churn remains elevated as OEMs and Dealers pre-empt June ’25 A/C-cabin regulations, while freight demand in coal, cement, and mining continues to be muted by liquidity bottlenecks and early rains. To navigate this lean yet resilient month, OEMs and financiers must synchronize production planning with ground-reality demand signals, deploy calibrated channel incentives, and secure adequate working-capital support. Collectively, these factors point to a cautiously optimistic near-term outlook for Auto Retail in June ’25.

Liquidity

o Neutral 49.78%

o Bad 31.00%

o Good 19.21%

§ Sentiment

o Neutral 54.15%

o Bad 28.38%

o Good 17.47%

§ Expectation from June’25

o Flat 55.46%

o Growth 31.00%

o De-growth 13.54%