Thread Starter

#1

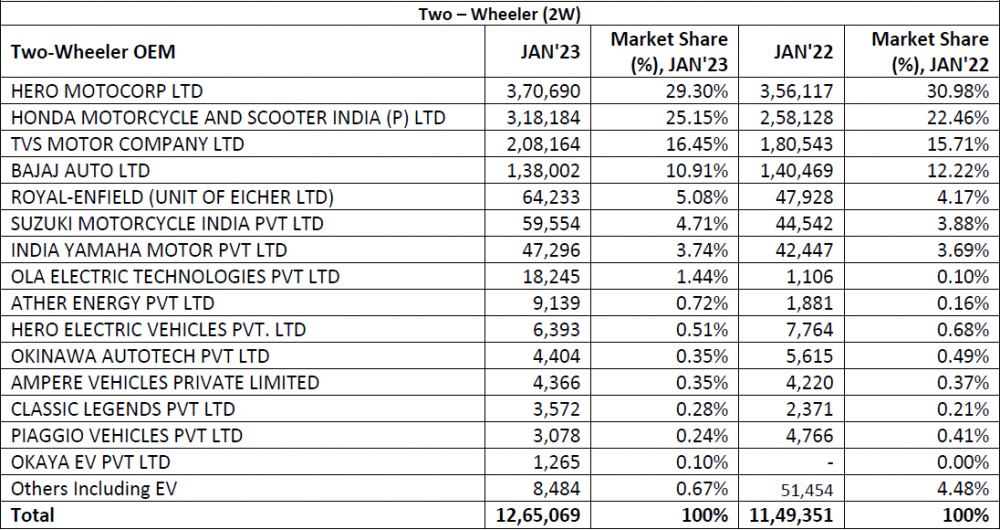

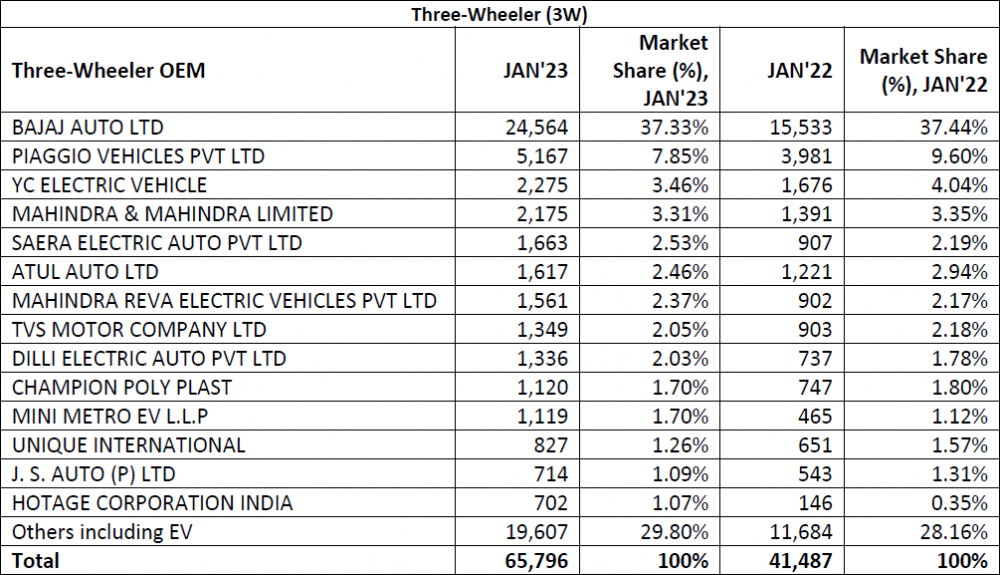

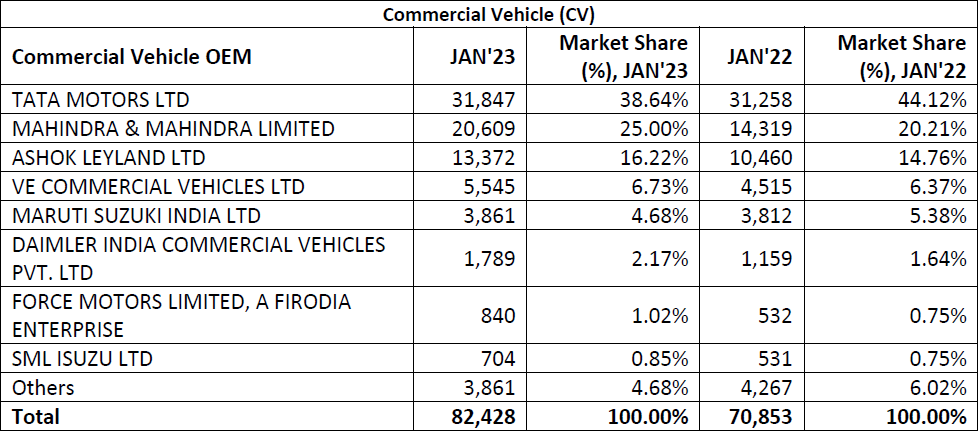

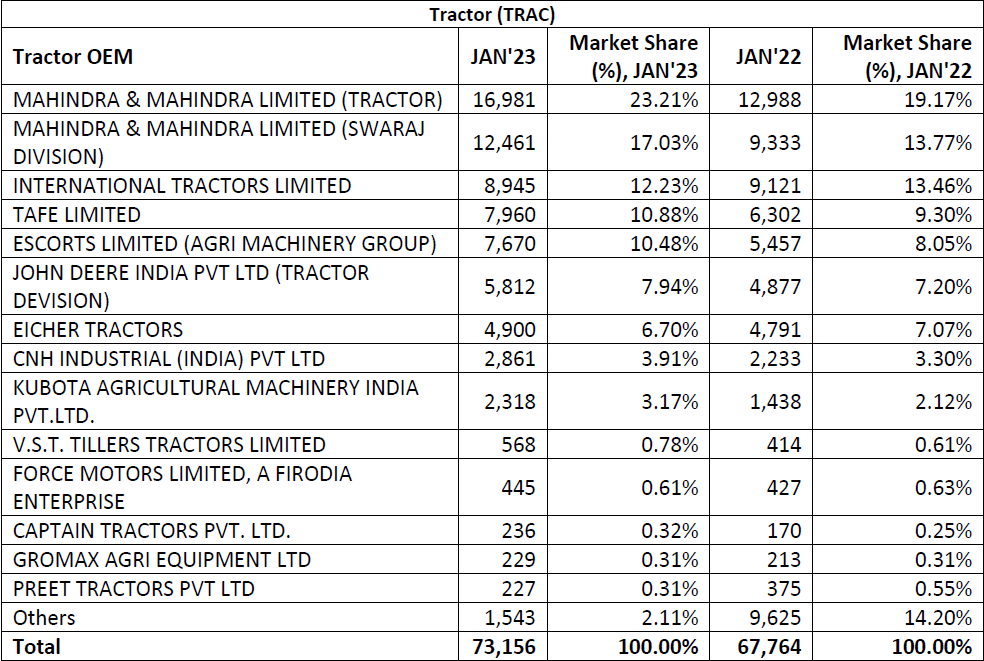

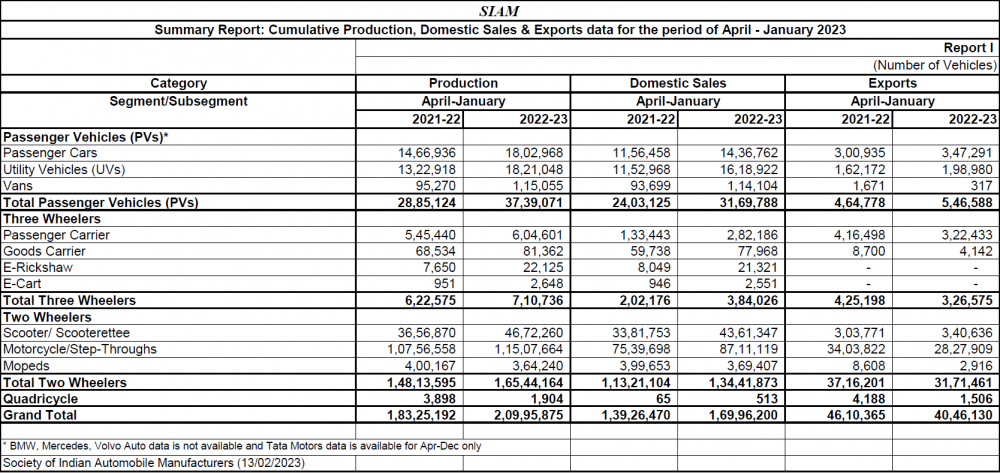

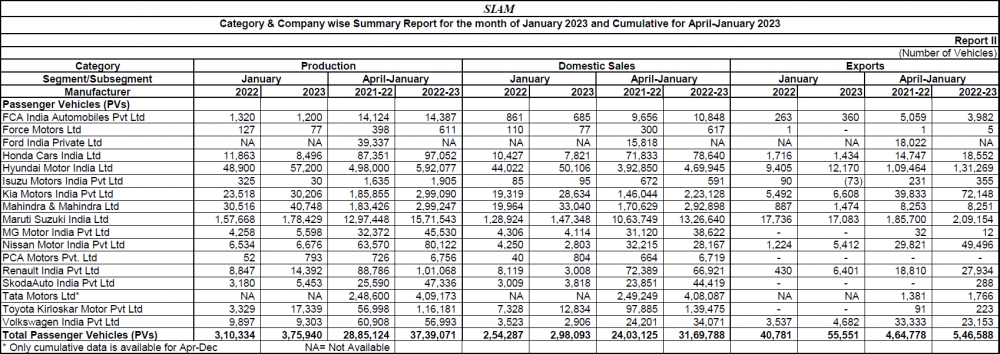

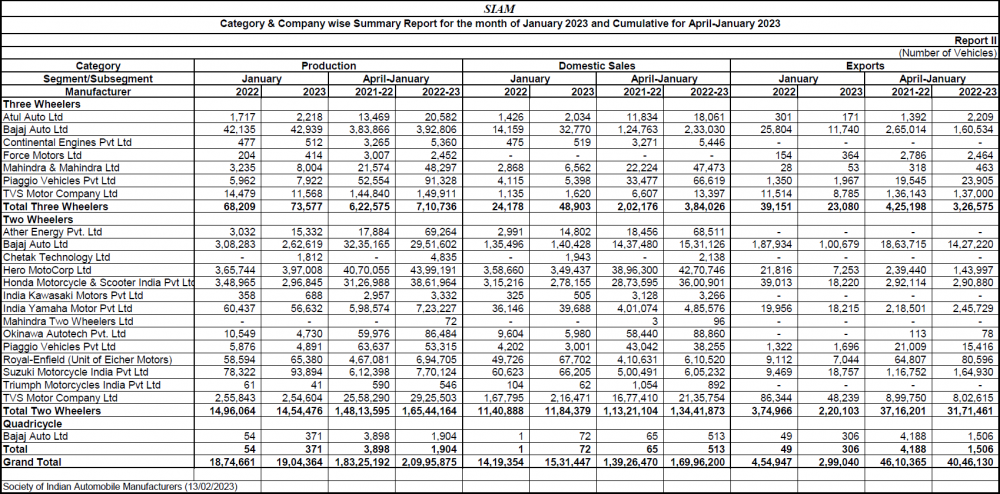

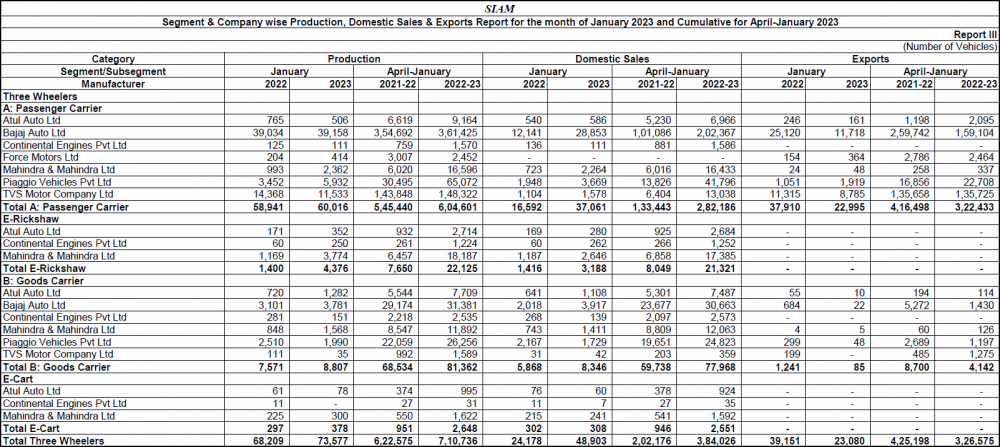

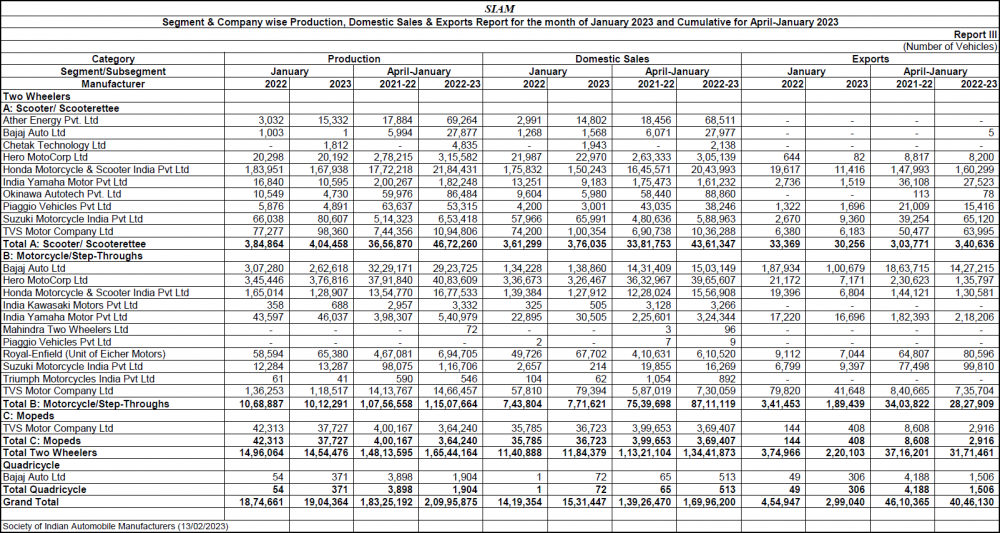

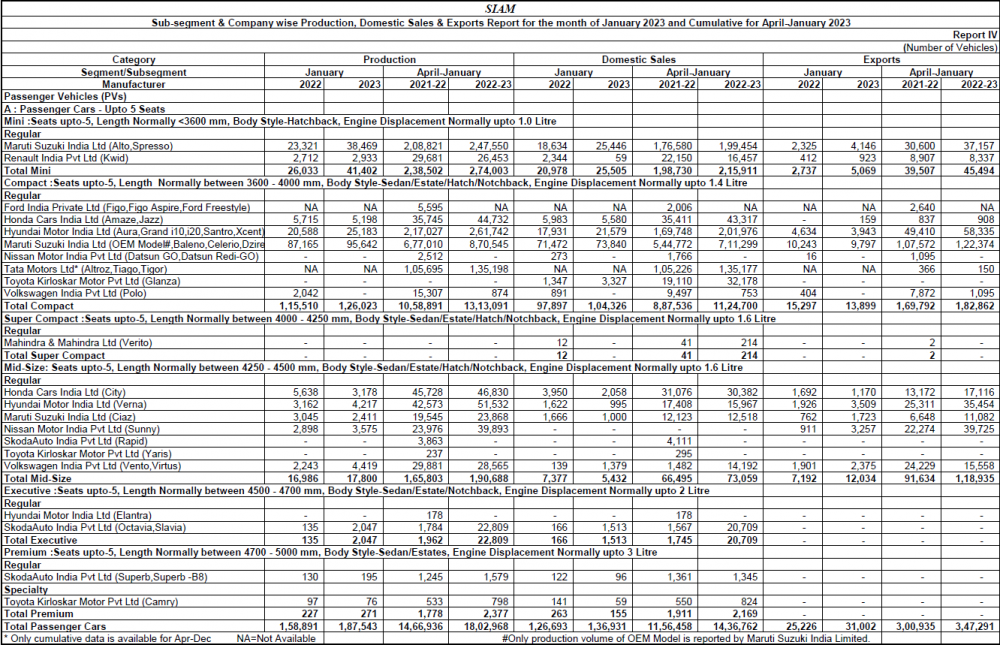

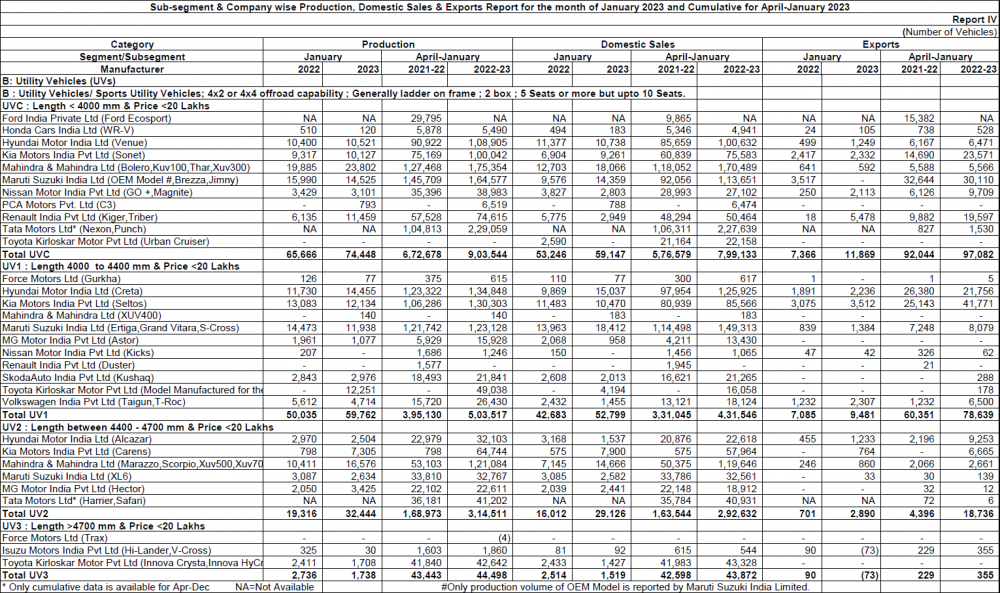

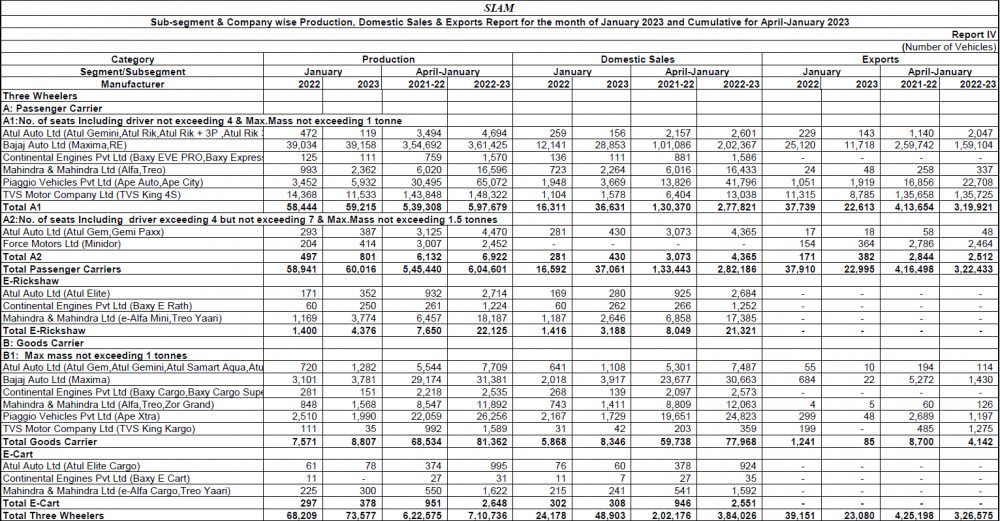

January 2023 Indian Car Sales

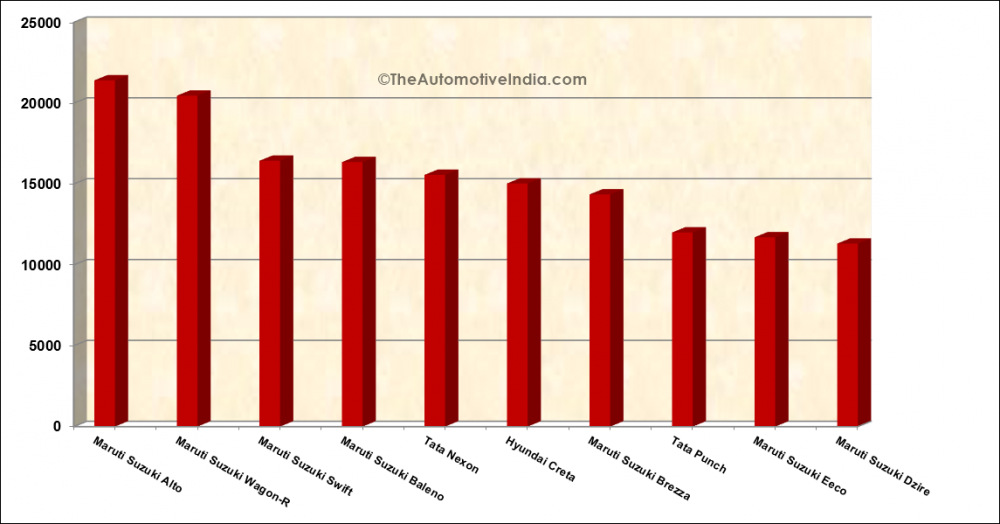

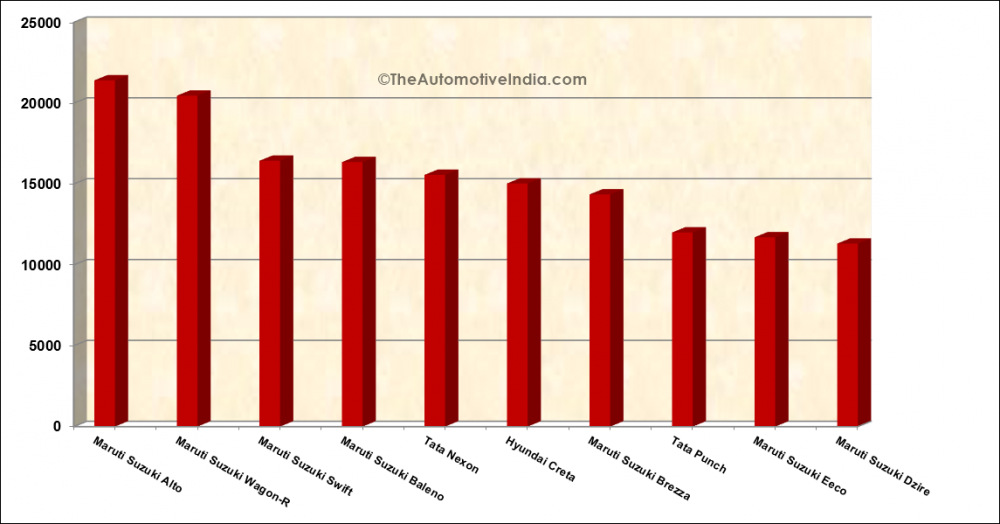

Top 10 Best Selling Cars: January 2023

Automakers' Market Share: January 2023

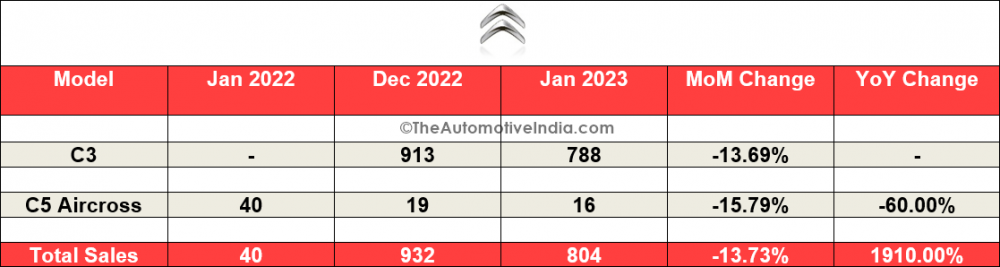

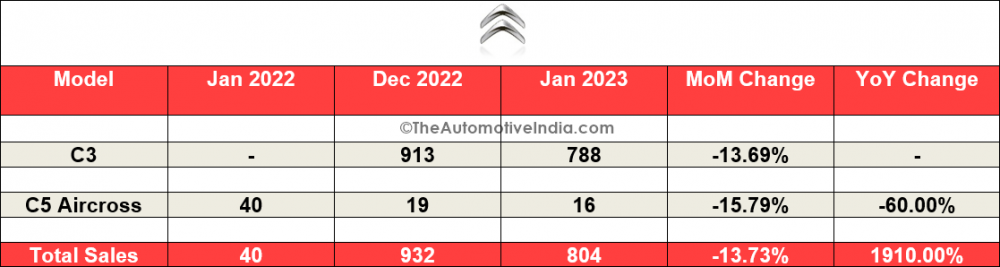

Citroën January 2023 Indian Car Sales

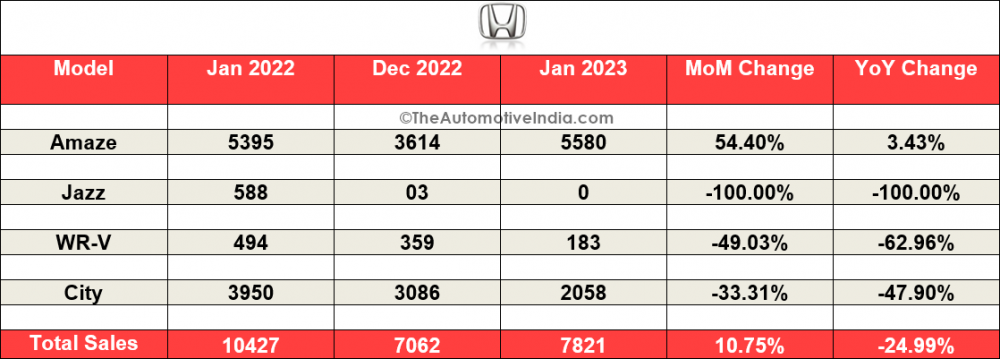

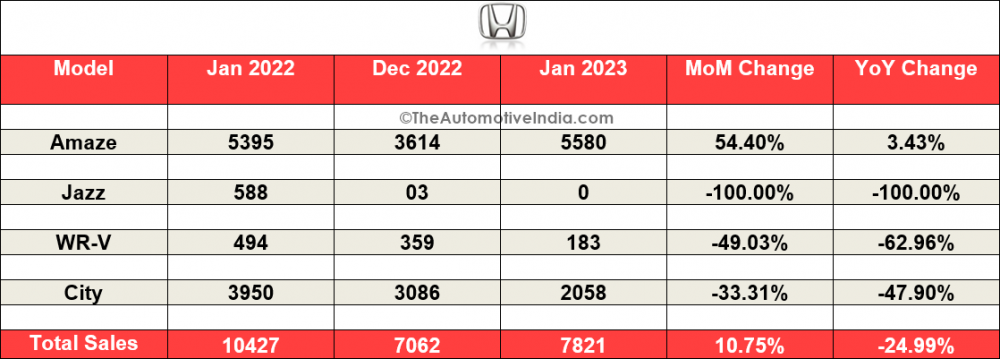

Honda January 2023 Indian Car Sales

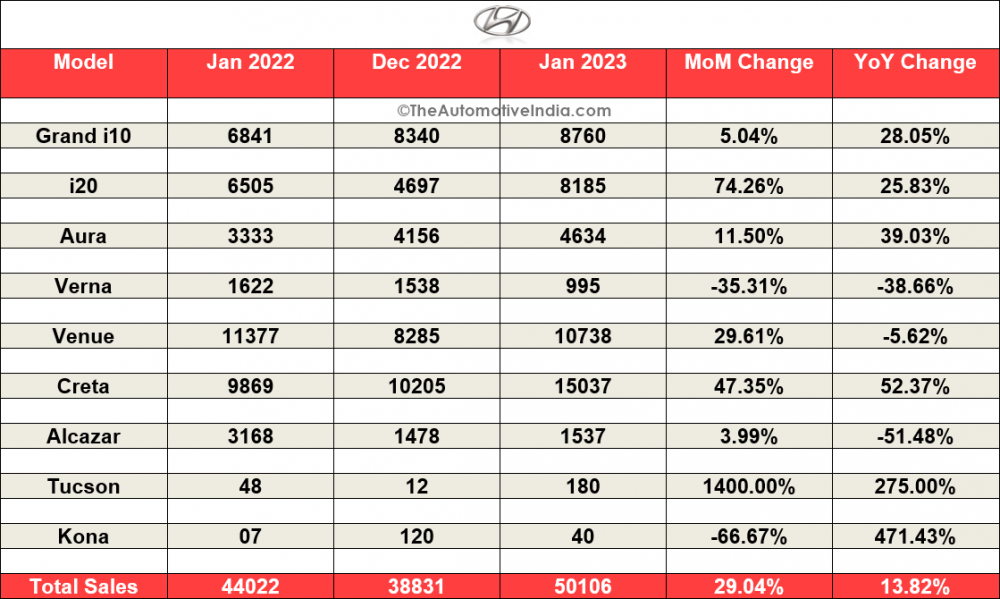

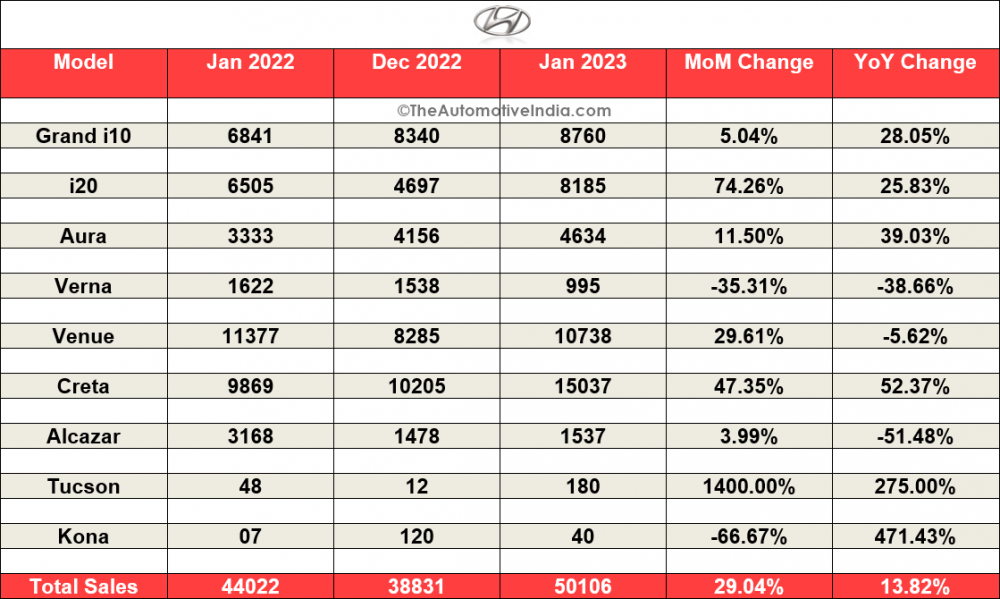

Hyundai January 2023 Indian Car Sales

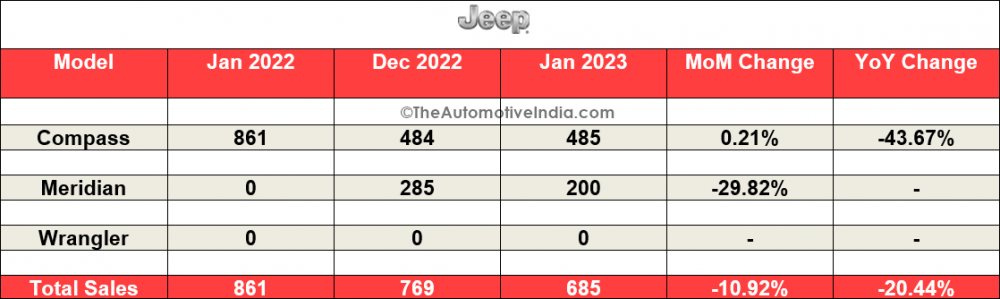

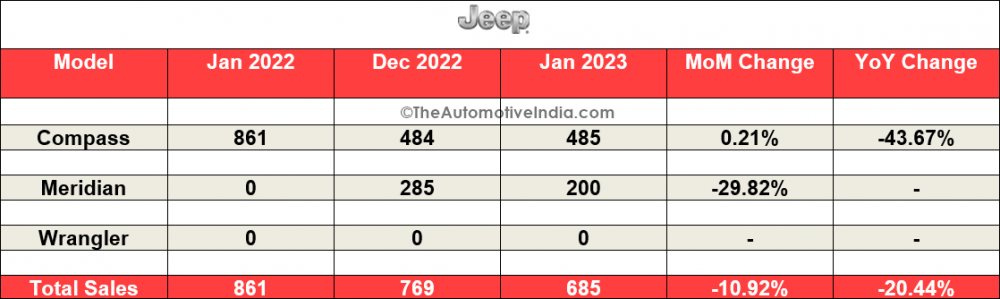

Jeep January 2023 Indian Car Sales

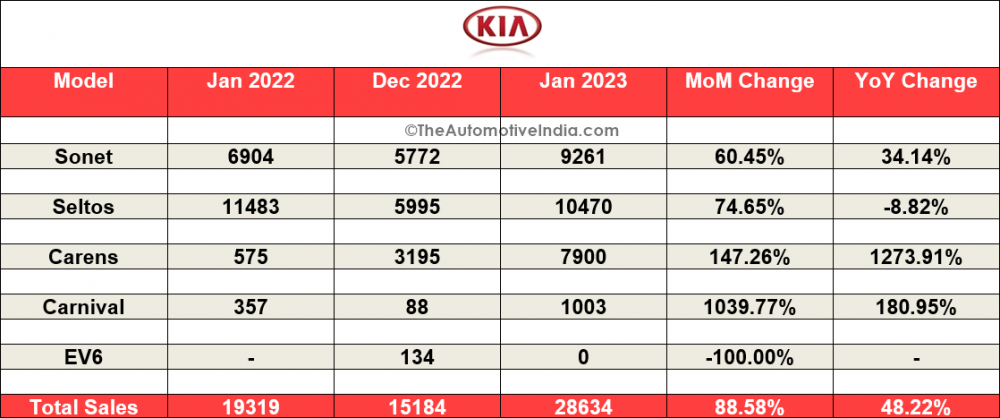

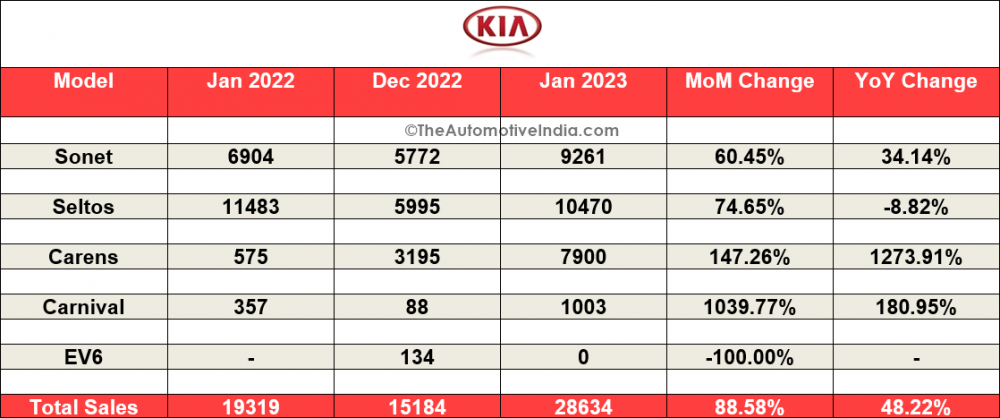

Kia January 2023 Indian Car Sales

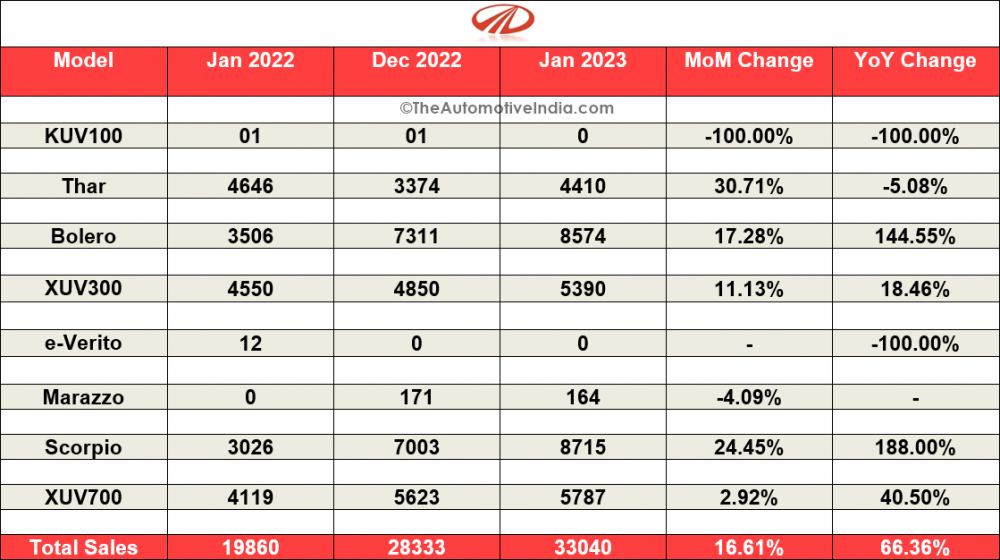

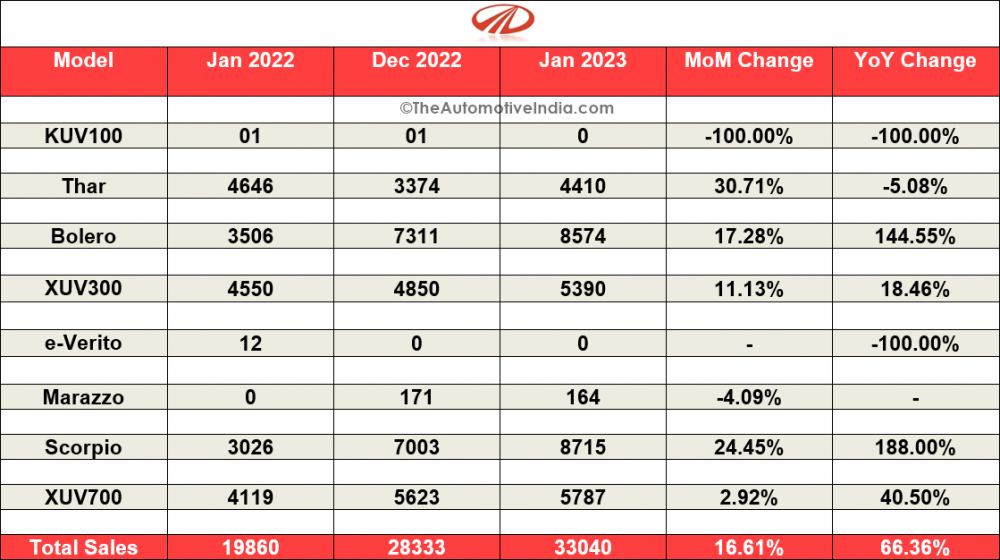

Mahindra January 2023 Indian Car Sales

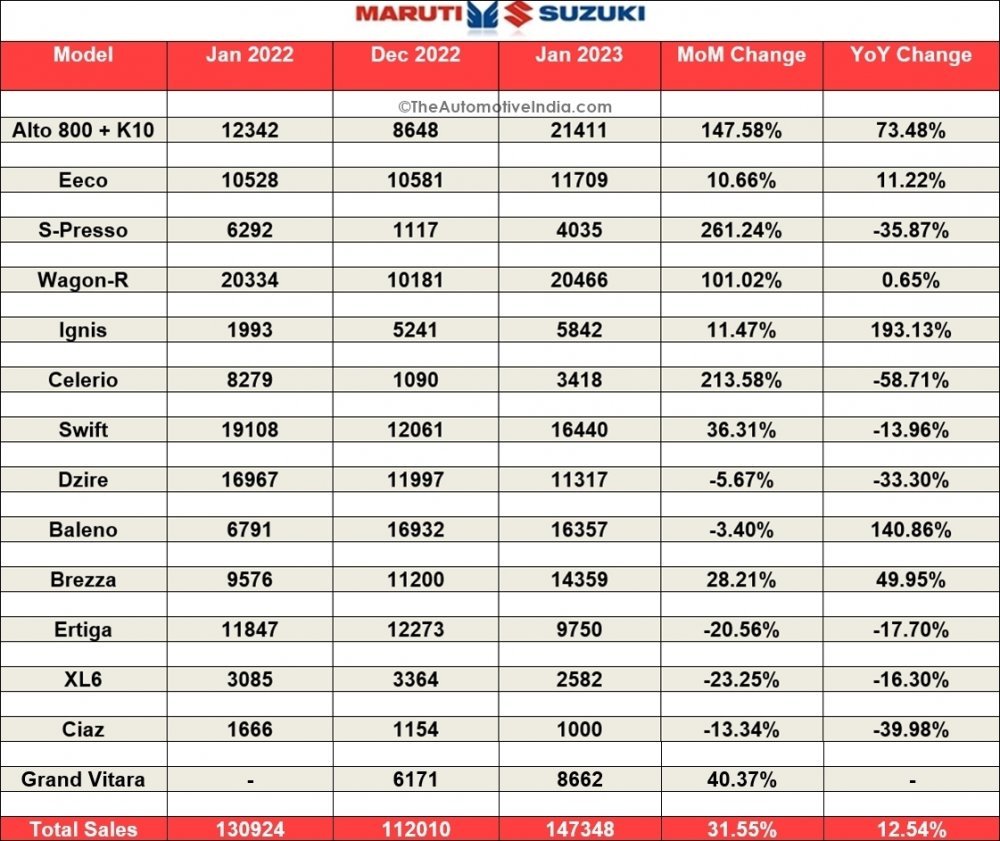

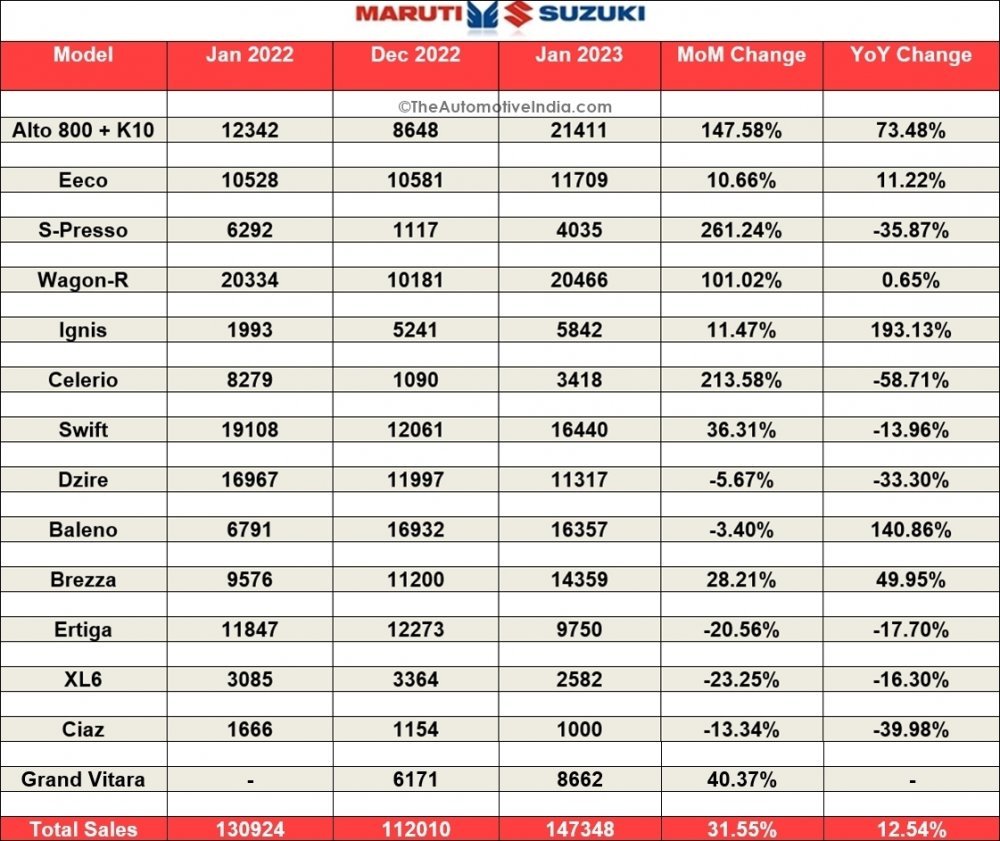

Maruti Suzuki January 2023 Indian Car Sales

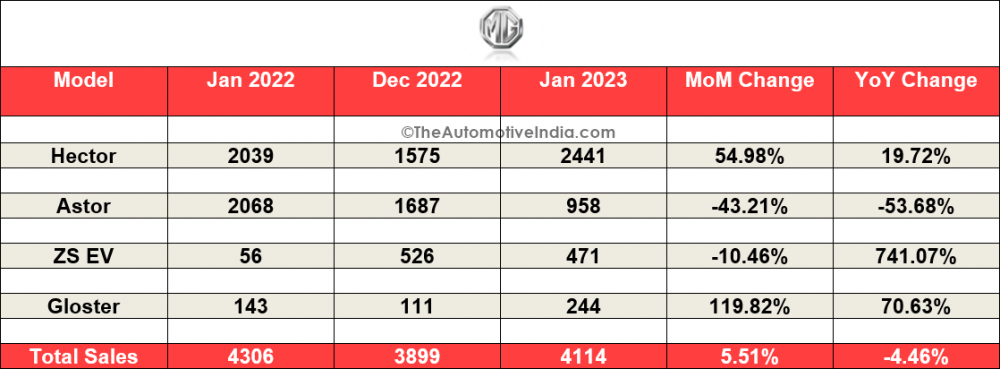

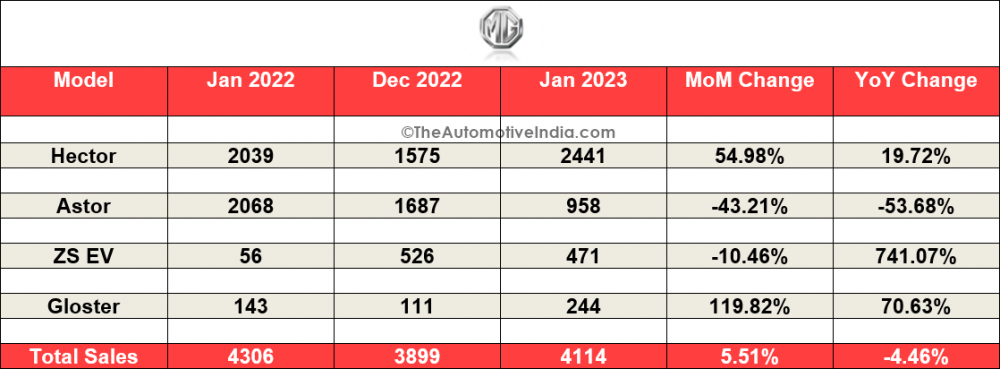

Morris Garages January 2023 Indian Car Sales

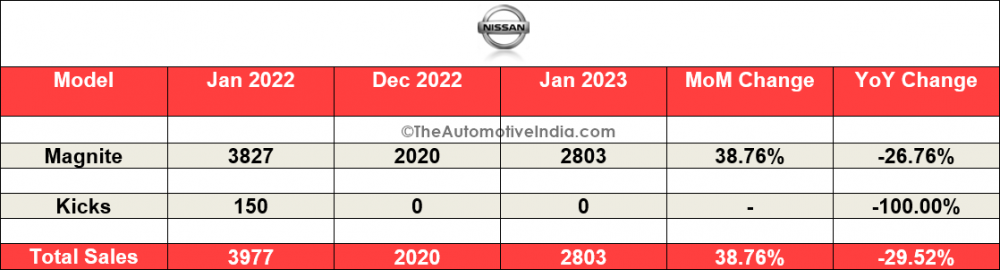

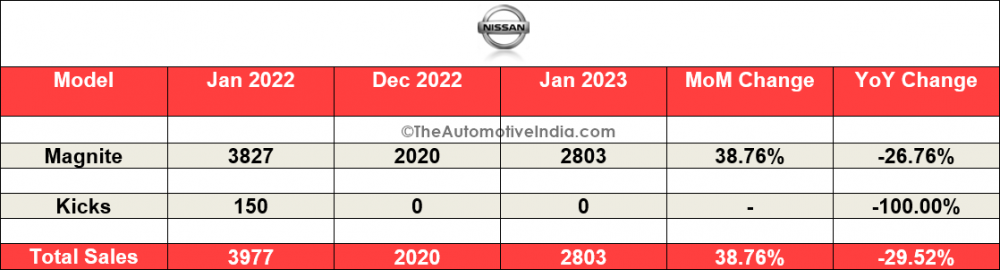

Nissan January 2023 Indian Car Sales

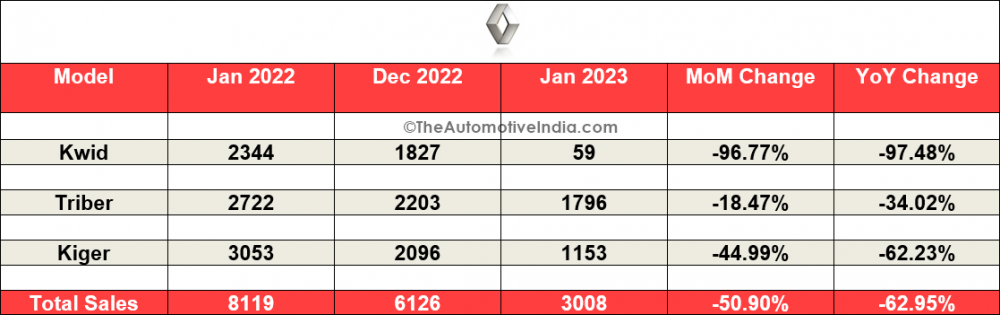

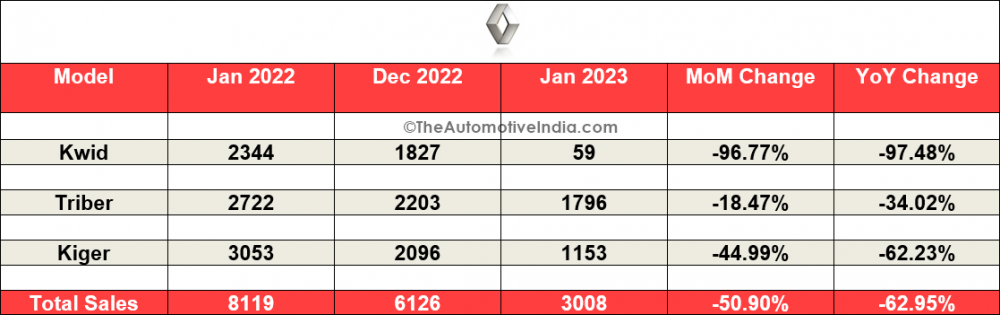

Renault January 2023 Indian Car Sales

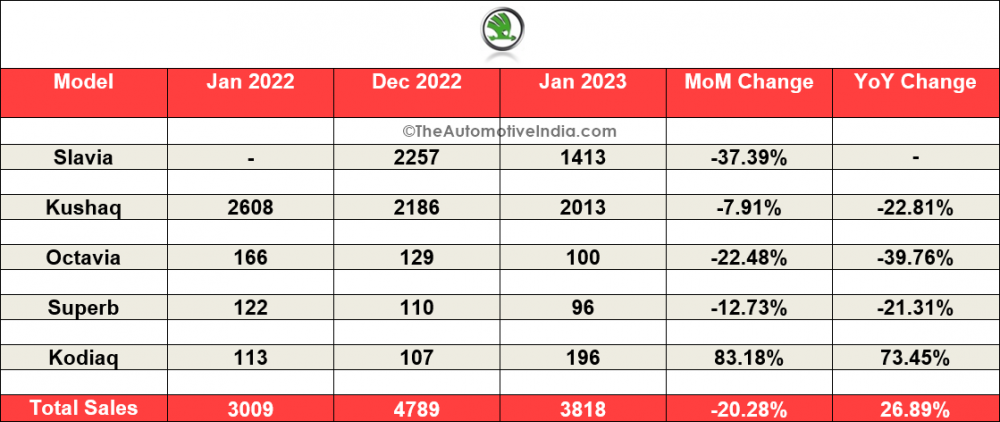

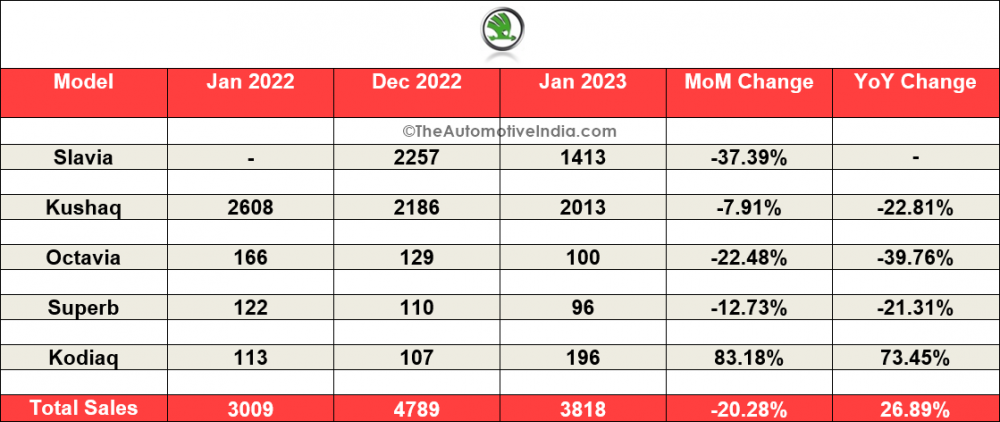

Skoda January 2023 Indian Car Sales

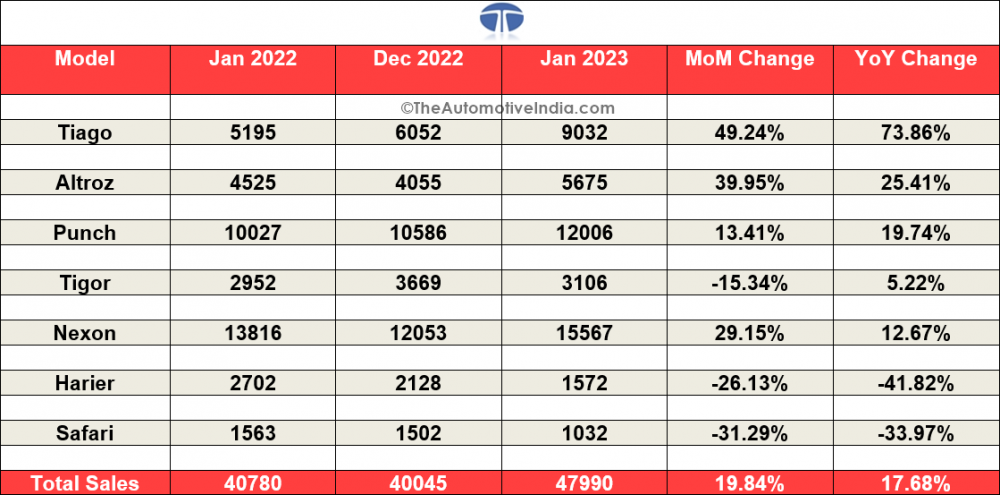

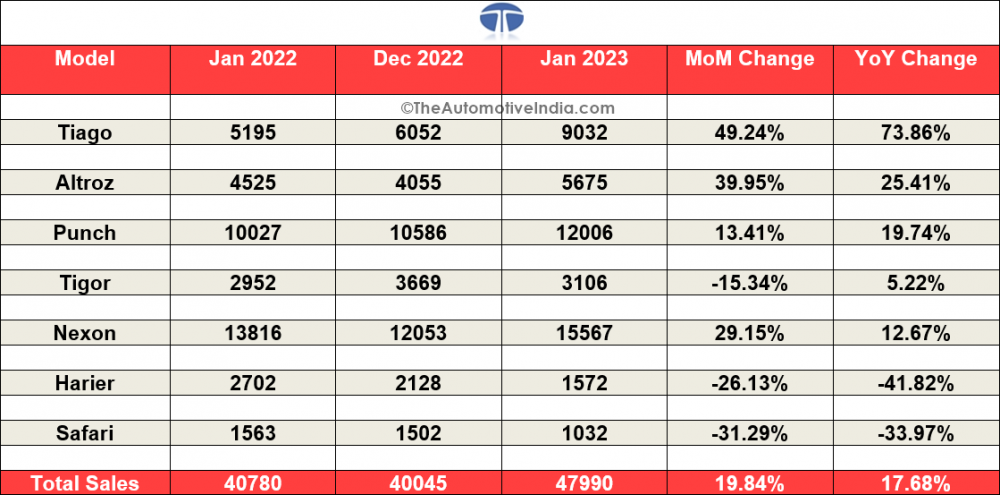

Tata Motors January 2023 Indian Car Sales

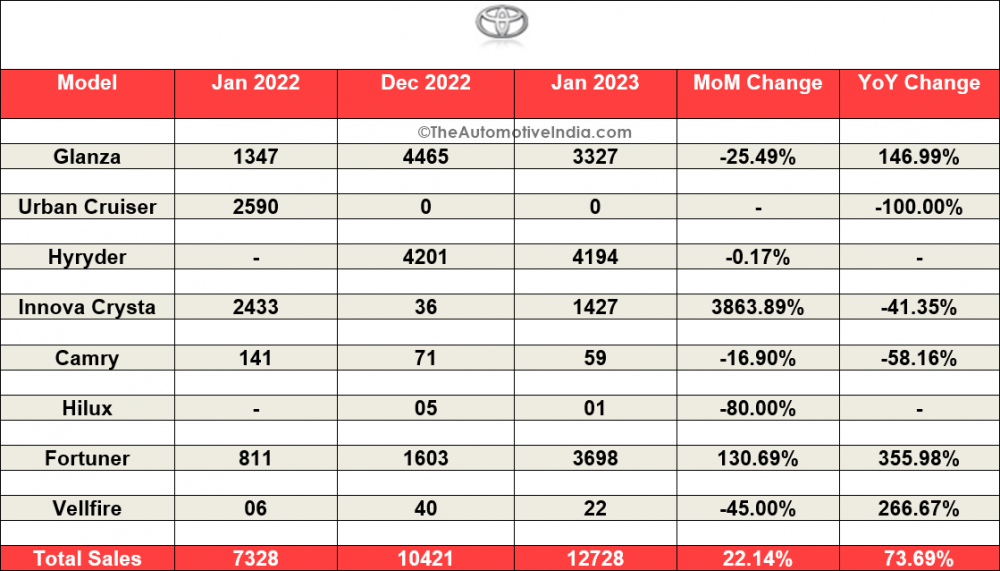

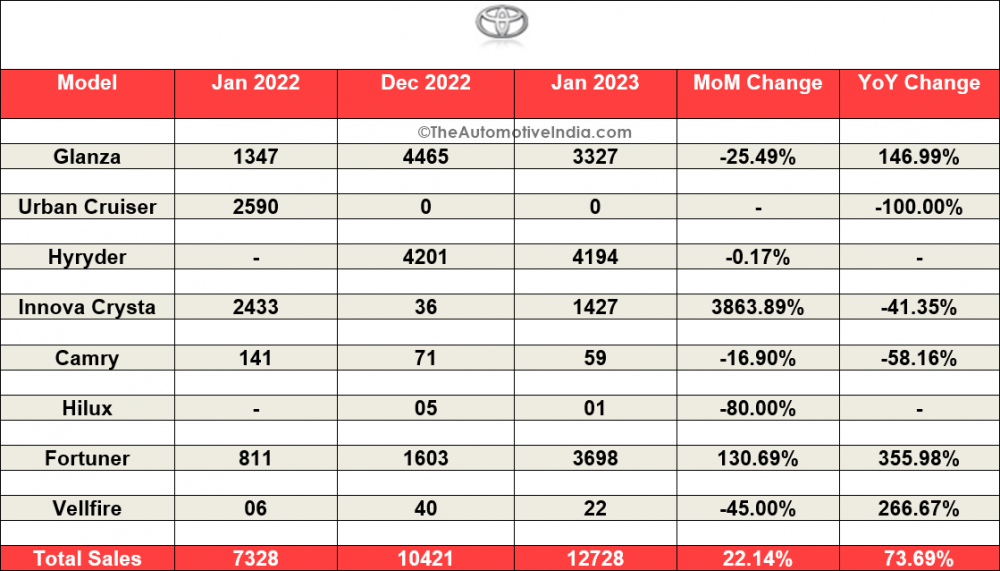

Toyota January 2023 Indian Car Sales

Volkswagen January 2023 Indian Car Sales

Top 10 Best Selling Cars: January 2023

Automakers' Market Share: January 2023

Citroën January 2023 Indian Car Sales

Honda January 2023 Indian Car Sales

Hyundai January 2023 Indian Car Sales

Jeep January 2023 Indian Car Sales

Kia January 2023 Indian Car Sales

Mahindra January 2023 Indian Car Sales

Maruti Suzuki January 2023 Indian Car Sales

Morris Garages January 2023 Indian Car Sales

Nissan January 2023 Indian Car Sales

Renault January 2023 Indian Car Sales

Skoda January 2023 Indian Car Sales

Tata Motors January 2023 Indian Car Sales

Toyota January 2023 Indian Car Sales

Volkswagen January 2023 Indian Car Sales

Drive Safe,

350Z