Honda Motorcycle & Scooter's to bring in more mass market models, reach ruler market.

Taking a leaf out of the well-honed strategy of the Munjals, its erstwhile partners, Honda Motorcycle & Scooter India (HMSI) is now working towards spreading its wings to far-flung towns as it aims to grow its market share in India.

The heart of the strategy is to bring in more mass market models and penetrate deeper by setting up 10 zonal offices across the country to be closer to the customer and react faster.

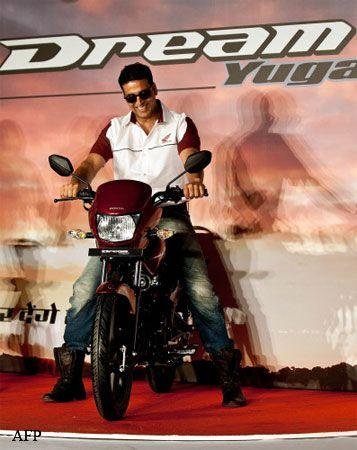

ET learns this is part of HMSI's five-pronged approach to gain market share in India. Other than reaching out to smaller towns and rural areas, the Japanese giant's India arm plans to build a mass market product portfolio, consolidate its leadership in scooters, use Bollywood star Akshay Kumar as a brand ambassador and work with vendors to bring down costs.

YS Guleria, vice president, sales & marketing at HMSI, says entry-level bike Dream Yuga is the biggest launch for the company in recent years and will give it a presence in over half of the market for two-wheelers.

"We want to be closer to the market with the launch of Dream Yuga. For the first time, we are going beyond regional offices to zonal offices and we are going to equip each of these zonal offices with training centers," said Guleria. In the current fiscal year, HMSI will add 500 touch points, many of which will be in smaller towns and rural areas.

Dream Yuga in the existing form will take on Hero's Passion, but going ahead there will be more motorcycles under the Dream series.

The next variant is expected to take on Hero MotoCorp's flagship bike, the Splendor, said people close to the development.

With the Dream Yuga in its portfolio, HMSI is aiming to grow by over 30% this fiscal by selling 2.75 million two wheelers. The company is also planning to boost capacity to 4 million units a year later.

Guleria is non-committal on specific model plans or number of launches, but admits the company is speeding up new model development.

"We would not like to reveal our exact model plan for the future due to competitive reasons. But suffice it to say that the 100 cc market has a lot of potential. In parallel, we will have to maintain our leadership in the automatic scooter segment, so we will continue to have new models," said Guleria. HMSI is a leader in scooters with a 45% market share.

Three people involved with HMSI's new projects told ET that in 2013-14, the company will come out with a 125 cc scooter codenamed K24A - based on Aviator platform - and an executive segment motorcycle (125-135cc) codenamed K23A to take on Bajaj Auto's Pulsar 135 LS. These launches will be before the entire scooter range comprising the Activa, Dio and Aviator are launched on an all-new platform.

Experts say HMSI is taking all the steps in right direction, right from R&D to branding. However, managing competitive pricing and spreading the distribution network in quick time will be the biggest challenges.

"HMSI will be able to command a 3-5% price premium, but it should not be too far away from Hero MotoCorp and Bajaj Auto's pricing; beyond that it will be a challenge. And quickly ramping up its network in hinterlands will play a key role in garnering larger market share," said V G Ramakrishnan, senior director, automotive, Frost & Sullivan.

Honda has already made it known that India will contribute 30% of its global volumes by 2020, more than twice the current 13%.

http://economictimes.indiatimes.com...s-reach-ruler-market/articleshow/14421511.cms

![Laugh [lol] [lol]](https://www.theautomotiveindia.com/forums/images/smilies/Laugh.gif)