One of the points that folks and good websites put up when buying insurance is that

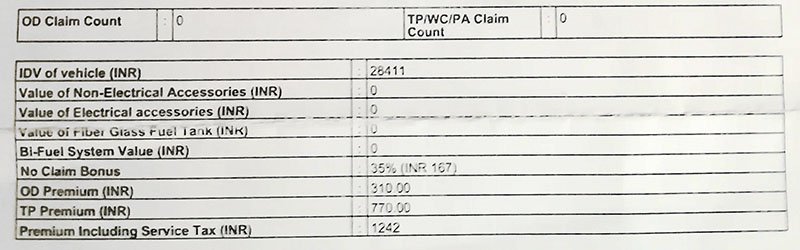

- always ensure the IDV of the vehicle is high when buying motor insurance.

I have always been following this advice. But this got me thinking. When does IDV matter? To my understanding

1. When there is a write down of car, the IDV is amount that will be given by the insurance company. In other words, if your insurance claims go beyond the IDV, the car is written off

2. IDV value matters when selling the car

(I request others to add any other benefits of high IDV)

Coming to point 2, IDV did not have any correlation with market valuation when I was trying to sell my car. My car was a low selling car and close to 8 years and this could have contributed to the selling price being less than IDV. Mind you, I tried keeping my IDV high through 8 years.

Coming to point 1, I completely agree that increased IDV is definitely a plus in this scenario.

With lower IDV, the insurance premiums are less and correct me if I am wrong, NCB (in value and not percent) for future years would also be less because the insurance premium is less. Now, since the insurance premium is less and the NCB value is also less, I would be tempted to use insurance for small damages by forgoing NCB. If the insurance premium was high, the loss of high value NCB would deter me from claiming insurance for small damages. So, having a lower premium would mean I would be tempted to use insurance.

So, this is the dilemma, should I prioritize write off value over smaller premiums.

What are your thoughts?

- always ensure the IDV of the vehicle is high when buying motor insurance.

I have always been following this advice. But this got me thinking. When does IDV matter? To my understanding

1. When there is a write down of car, the IDV is amount that will be given by the insurance company. In other words, if your insurance claims go beyond the IDV, the car is written off

2. IDV value matters when selling the car

(I request others to add any other benefits of high IDV)

Coming to point 2, IDV did not have any correlation with market valuation when I was trying to sell my car. My car was a low selling car and close to 8 years and this could have contributed to the selling price being less than IDV. Mind you, I tried keeping my IDV high through 8 years.

Coming to point 1, I completely agree that increased IDV is definitely a plus in this scenario.

With lower IDV, the insurance premiums are less and correct me if I am wrong, NCB (in value and not percent) for future years would also be less because the insurance premium is less. Now, since the insurance premium is less and the NCB value is also less, I would be tempted to use insurance for small damages by forgoing NCB. If the insurance premium was high, the loss of high value NCB would deter me from claiming insurance for small damages. So, having a lower premium would mean I would be tempted to use insurance.

So, this is the dilemma, should I prioritize write off value over smaller premiums.

What are your thoughts?

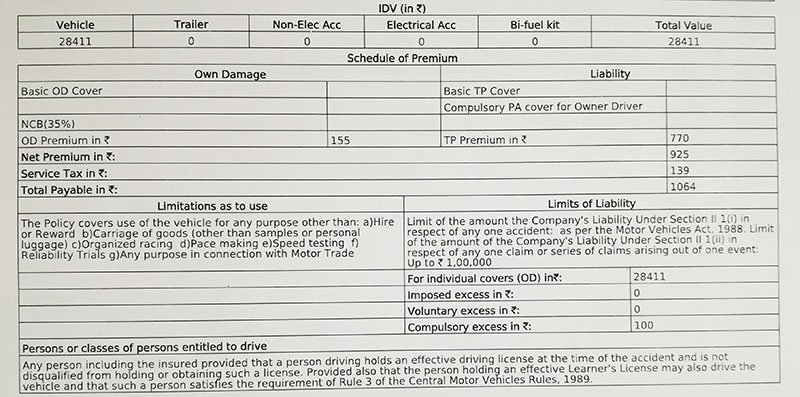

In accident constructive total loss/salvage loss settlements, where repair cost exceeds 75% of the IDV, there is possibility to get some recovery value from salvage, they will identify a salvage buyer with whom you need to enter an agreement to sell the salvage and the net payment would be made to you after deducting the salvage amount.

You might be even be forced to go the legal route if you want to insist on full IDV settlement. Unless the difference between IDV and market value is so huge, it might not be worth contesting the amount. So getting the full IDV when you've insured over and above the market value will be very tough though possible, but do you really want a full-fledged dispute over the insurer for the balance amount? The time and money spent in legal proceedings might not be worth it. Note that any Insurance company will always try to minimize their loss.

I would suggest going for the normal IDV that the company offers. Paying a higher premium for a higher IDV might not necessarily result in a benefit, and that too you need to consider what are the chances that you will get a total loss. At least, even if they negotiate for market value, it may not be much less than the IDV.

Higher IDV sounds tempting, but the fact is you need to consider:

1. it is irrelevant for normal repair claims where the repair option is feasible and viable.

2. anyway insurer will always try to negotiate settlement at market value in total loss claims.

3. what are the chances of going for a total loss / salvage loss claim?'4

Finally note that anway insurance company will not give you an excessively high IDV anyway. At best you may get a variation +/-20% on the normal IDV.

Last edited:

![Big Smile [:D] [:D]](https://www.theautomotiveindia.com/forums/images/smilies/Big%20Smile.gif)

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)