Mission: Getting my Vehicle Re-registered in Bangalore.

Pre-Planning: Getting and knowing the procedure of the same and getting more confused with the process. Asking friends who had no clue about the registration process .... then bombared back with question .. why do u have to !! ... leave it man !! ... just hand over a "sau ka pathi" .... you paid the road tax once you should not paid it again .... why are you paying so much tax in Bangalore .... and on and on ... What to tell them .. " This is India .. thats what the rule say's so be it. At last internet, sitting for hours on what's and how. Thanks to @ figoian for the thread and even a million thanks to @ Mahajany for the detailed description and giving the courage that YES things can be done in Government office, all one needs it " Nahi aaj tho kar ke rahunga ye kaam".

Scene 1: Plotting ... getting familiar with the place and getting all possible info on Where & How

Today visited the KR Puram RTO office ( which is the RTO for my place checked it on the RTO site ). Lot of activity for the RTO office which seems to unusual place for such an office .. but this is the place to get licence to drive. Checked out all the possible shops and Xerox shops. Zeroed in one of the Shop that towards the right side of the office main entrance. Started the mission with a cup of hot tea ( from the same shop ) observed what going on and which type of people are coming. By the time my tea was over i got the entire list what i needed as mentioned by Mahajany. From 27, KMV 27, Form 33 & Form 14 alonf with File, tag & the transparent ply bag ( million thanks again mahajany for the details

![Clap [clap] [clap]](https://www.theautomotiveindia.com/forums/images/smilies/Clap.gif)

) As shown in the pic, as i was confused with file, the pic can be helpful for people who are venturing into the RTO for the same.

At Last ready with all the paper ( and some extra KMV 27 as mahajany mentioned ) went inside the RTO just to check out the office and rooms and the stair where will have to do the running around.

So all set now that i know the playgrounds ..... I'll be back.

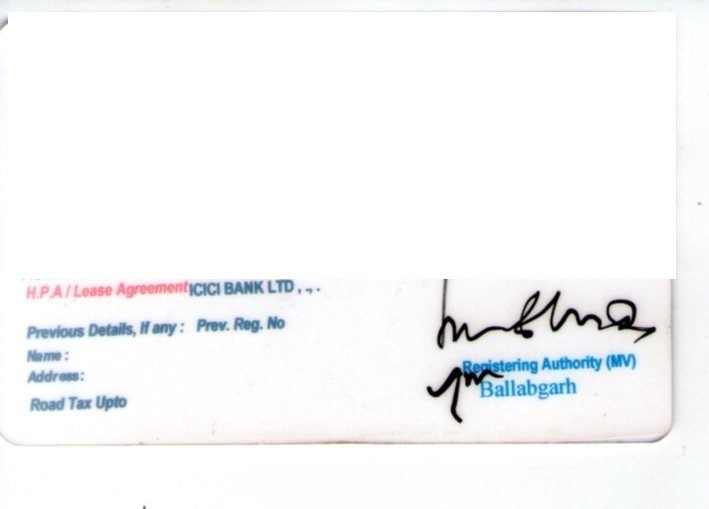

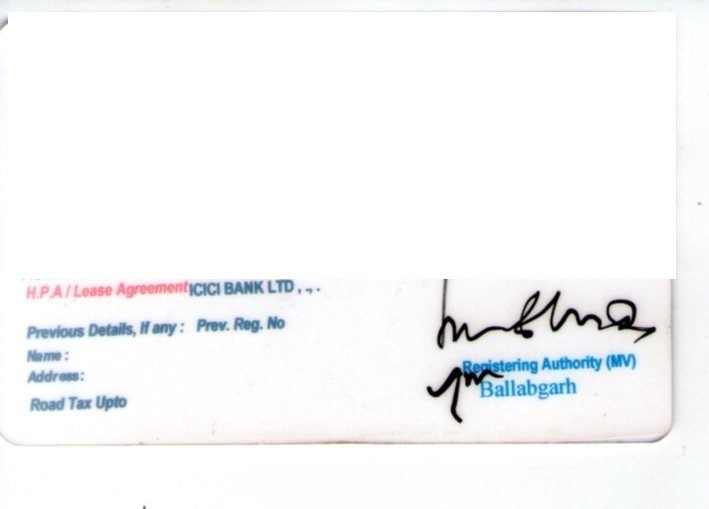

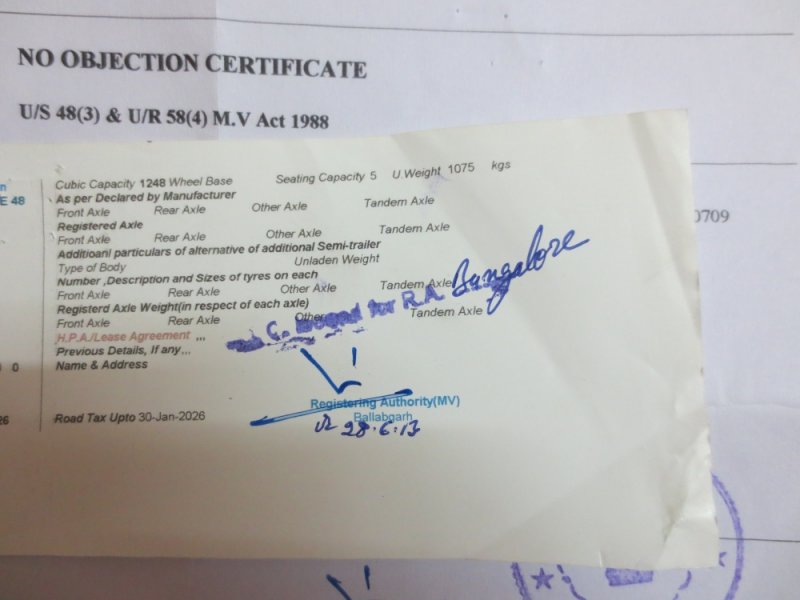

@ Figoian. The tax part that i talked about, i checked my RC it dsn't say anything about the tax on the back side on the last line it say "Road tax upto" is the same as LTT !?!

@ Figoina this is what i was talking about and the wrong Hypothecation

![Anger [anger] [anger]](https://www.theautomotiveindia.com/forums/images/smilies/Anger.gif)

![Cry [cry] [cry]](https://www.theautomotiveindia.com/forums/images/smilies/Cry.gif)

![Big Smile [:D] [:D]](https://www.theautomotiveindia.com/forums/images/smilies/Big%20Smile.gif)

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif) .

. ![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif) and that will also be included on the LTT to be paid in Bangalore.

and that will also be included on the LTT to be paid in Bangalore.![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif) .

. ![Laugh [lol] [lol]](https://www.theautomotiveindia.com/forums/images/smilies/Laugh.gif) will work out that amount for you.

will work out that amount for you.![Clap [clap] [clap]](https://www.theautomotiveindia.com/forums/images/smilies/Clap.gif) ) As shown in the pic, as i was confused with file, the pic can be helpful for people who are venturing into the RTO for the same.

) As shown in the pic, as i was confused with file, the pic can be helpful for people who are venturing into the RTO for the same.

![Anger [anger] [anger]](https://www.theautomotiveindia.com/forums/images/smilies/Anger.gif)

![Glasses [glasses] [glasses]](https://www.theautomotiveindia.com/forums/images/smilies/Glasses.gif) too many gyans and too many suggestion.

too many gyans and too many suggestion. ![Frustration [frustration] [frustration]](https://www.theautomotiveindia.com/forums/images/smilies/Frustration.gif)