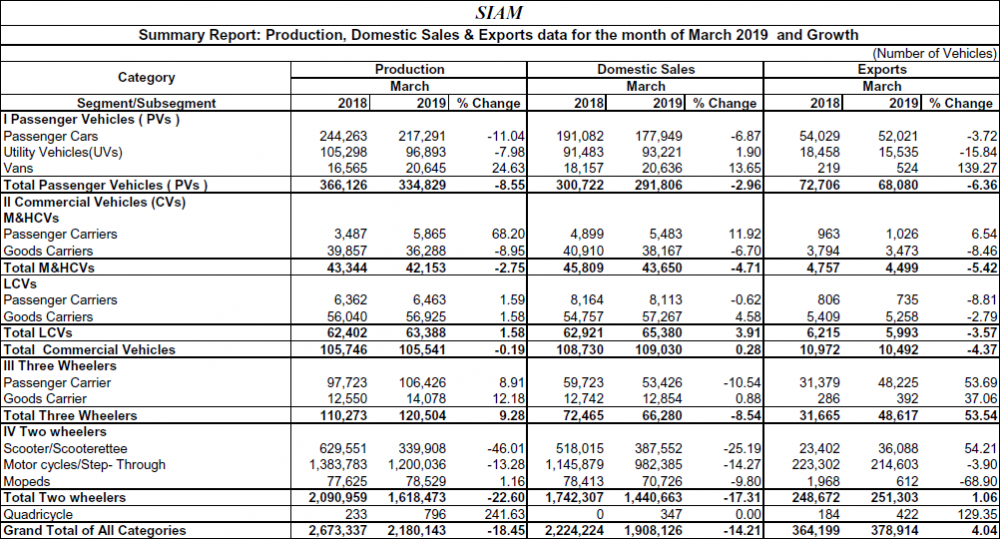

10th April’19, New Delhi: The Federation of Automobile Dealers Associations (F A D A) today released the Monthly Vehicle Registration Data for the month of March’19.

Retail Sales

Commenting on the yearly and monthly performance, F A D A President, Mr Ashish Harsharaj Kale said, “I am happy to share that at the retail front, the Indian Auto Sector has managed to close FY19 on a positive note. All the segment echoed positivity in March when compared to February sales, with 2W leading the charge with a healthy growth of 10% which indicated slight improvement in consumer sentiment and liquidity availability.

For the month of March’19, on a Year on Year basis, there was de-growth in all the categories as March’18 was one of the biggest months for Retails last fiscal. The Industry showed positive signs on a monthly basis as compared to February’19

Dealer Inventory

Inventory reduction by way of Production cut is a painful decision for all stake holders, especially OEM’s and that too in a growing market like India and I am thankful to our Principals for understanding the pain and pressure that Auto Dealers were going through with Historically High Inventory and that too in such a Tight Liquidity Situation.

F A D A appreciates and applauds the bold steps taken by majority of OEMs for regulating production to current demand and helping dealers in reducing inventory.

The inventory reduction in March, with further reduction expected in April, will help get the Dealers to normal inventory levels of 30 days and will form a good base as we enter the new financial year with renewed expectation and positivity.

Liquidity

For the Month of March, Liquidity, both for the Consumer and the Dealer, remained very tight and Operating Cost of Auto Dealerships were at its Peak, owing to Higher Inventory and Selling Costs.

RBI has already initiated measures which will result in Easing of Consumer Liquidity and we Expect the Easing to Continue in the coming months.

The Dealer Community has faced one of the toughest times in Dealer Liquidity and Adequate Working Capital Availability in the past 6 months and in few cases, even threatening the survival of their business. F A D A will engage with the newly elected policy makers of our nation, post the elections and will be advocating a separate Working Capital Policy for Auto Retail, which will aid in its continued sustainable growth.

Auto Retail is one of the highest Employment Providers to the Urban as well as Rural Economy, providing 25 lakh direct jobs and an equal number of indirect jobs.

Near Term Outlook

Commenting further F A D A President said, “We at F A D A believe that the worst for Auto Industry is now behind us and expect Plateauing of the declining Demand and expect Sales to Stabilise in their Current Normal Range for the next 4-6 weeks till India’s biggest democratic Festival, The Elections, Conclude and we head towards the onset of the monsoon.

F A D A would like to mention that the Inquiry De-growth has not been as much as Actual Retail Sales De-growth and although the current customer sentiment is Negative-to-Neutral for Purchase Decision, Consumers’ Interest towards Automobiles still remains reasonably robust.

A Stable Government at the Centre, an Above Average or Average Monsoon and most importantly a Continued Easing Monetary Policy by the RBI, which has been initiated by the New RBI Governor, resulting in Liquidity availability, are factors which will once again begin the positive run of Indian Auto Retails and we expect that to continue into the festive season.

We believe that Inquiry to conversion ratio will improve if positive factors mentioned above start playing out.