Thread Starter

#1

Hi,

I have obtained NOC for my car from RTO, KR Puram, Bangalore in Oct 2011. Registered the car in Trivandrum, Kerala in March 2012 and got a new number.

Now, due to a change in job, I am again moving back to Bangalore. What is the registration process?

Is it enough if I get NOC from Trivandrum RTO? I have already paid life time road tax in Karnataka. Will I get the old number or do I get new number again?

If the process is so complicated, I would like sell the car and go for a new one... ofcourse, it would be a big loss of money :(

Incase, I sell the car, what is the procedure to get tax refund from Kernataka RTO? What are the documents I should obtain from Trivandrum/kerala for claiming the refund from karnataka?

If I want to use NCB on my old car, what is the procedure?

Thank you,

I have obtained NOC for my car from RTO, KR Puram, Bangalore in Oct 2011. Registered the car in Trivandrum, Kerala in March 2012 and got a new number.

Now, due to a change in job, I am again moving back to Bangalore. What is the registration process?

Is it enough if I get NOC from Trivandrum RTO? I have already paid life time road tax in Karnataka. Will I get the old number or do I get new number again?

If the process is so complicated, I would like sell the car and go for a new one... ofcourse, it would be a big loss of money :(

Incase, I sell the car, what is the procedure to get tax refund from Kernataka RTO? What are the documents I should obtain from Trivandrum/kerala for claiming the refund from karnataka?

If I want to use NCB on my old car, what is the procedure?

Thank you,

Last edited:

![Frustration [frustration] [frustration]](https://www.theautomotiveindia.com/forums/images/smilies/Frustration.gif)

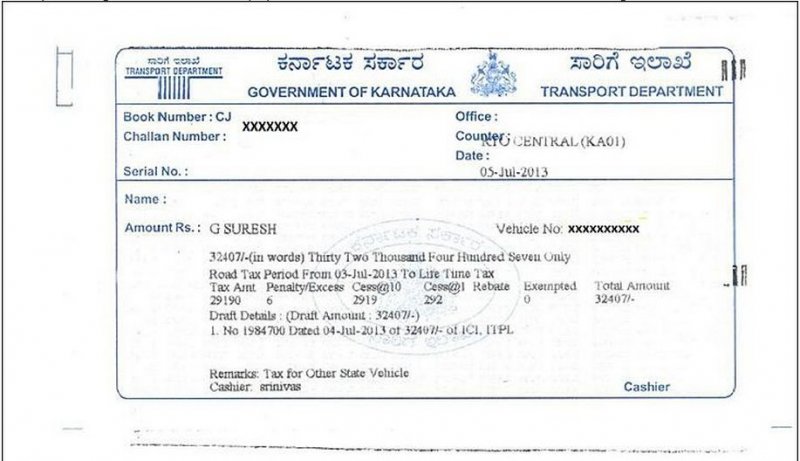

![Thumbs Up [thumbsup] [thumbsup]](https://www.theautomotiveindia.com/forums/images/smilies/Thumbs%20Up.png) . But cops won't ask for Toll receipts as a proof of entry date?. I think things are different in Karnataka from one of the above posts by suresh-gs. Seemingly there you can pay just road tax without changing the registration.

. But cops won't ask for Toll receipts as a proof of entry date?. I think things are different in Karnataka from one of the above posts by suresh-gs. Seemingly there you can pay just road tax without changing the registration.![Big Smile [:D] [:D]](https://www.theautomotiveindia.com/forums/images/smilies/Big%20Smile.gif)