Thread Starter

#1

Nearly Half of India Dealers Use Digital Media to Reach Out to Prospective Buyers, J.D. Power Finds

Toyota, Royal Enfield and Ashok Leyland Rank Highest in the Passenger, Two-Wheeler and Commercial Vehicle Segments, Respectively

Toyota, Royal Enfield and Ashok Leyland Rank Highest in the Passenger, Two-Wheeler and Commercial Vehicle Segments, Respectively

SINGAPORE: 31 May 2018 — Across the passenger, two-wheeler and commercial vehicle segments, nearly half of dealers are using digital media to reach out to prospective buyers, according to the J.D. Power 2018 India Dealer Satisfaction with Automotive Manufacturers Index (DSWAMI) Study,SM released today.

J.D. Power’s 2017 India Sales Satisfaction Index StudySM showed that during the past five years, vehicle owners who are 30 years or younger have been using traditional outlets far less often as their information source —notably with declines in television (45% in 2012 vs. 24% in 2017) and newspapers/magazines (53% in 2012 vs. 20% in 2017)—while shopping online for a vehicle has increased by 28 percentage points (28% in 2012 vs. 56% in 2017) during the same period.

“We are increasingly finding that shoppers, particularly in the younger age bracket, are using the internet as their chosen channel to search for product specifications, pricing and promotional offers, reviews and evaluations,” said Shantanu Nandi Majumdar, Regional Director, Automotive Practice at J.D. Power Singapore. “This consumer preference demonstrates how crucial it is for dealers—with the support of their OEMs—to develop their digital strategy to enhance interaction with potential buyers.”

The study finds that nearly 60% of passenger-vehicle dealerships expect that more new-car buyers will purchase their vehicles online instead of from traditional dealer showrooms. This proportion has increased by 14 percentage points since 2016 (43% in 2016 vs. 57% in 2018). Interestingly, the opinion of two-wheeler and commercial vehicles dealerships regarding the possible shift to online sales is divided, with only four in 10 dealerships forecasting such a scenario in the future.

“Passenger-vehicle dealers today are not only interacting digitally with their customers and offering test drives at home, but also working alongside manufacturers to bring the digital showroom into their customers’ homes. The need for customers to visit a showroom to merely see the vehicle or to make enquiries may not be necessary in the future as digital solutions, such as augmented reality or dynamic virtual test drives, will enhance convenience and transparency in the buying process,” added Majumdar.

The following are additional key findings of the study:

Expectations for another profitable financial year: Among the passenger-vehicle dealers surveyed, 63% expect a profitable financial year, which is the highest since 2013. More than half of two-wheeler and commercial vehicle dealers also expect a profitable year, which is higher than in 2017, when two-wheeler and commercial vehicle dealers were first surveyed in the study. Approximately, six in 10 dealers across the three segments expect their profits to be better in 2018 than in 2017.

Retaining manpower proving to be a challenge: Dealers, across the three vehicle segments, continue to have challenges in retaining manpower, with nearly one-fourth of their employees in sales, after-sales service as well as technicians leaving the dealership every year.

Study Rankings

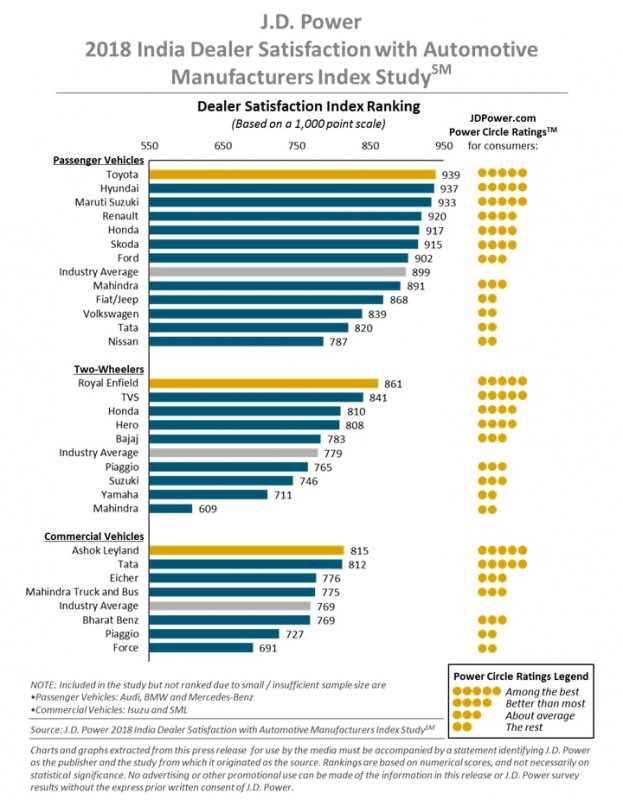

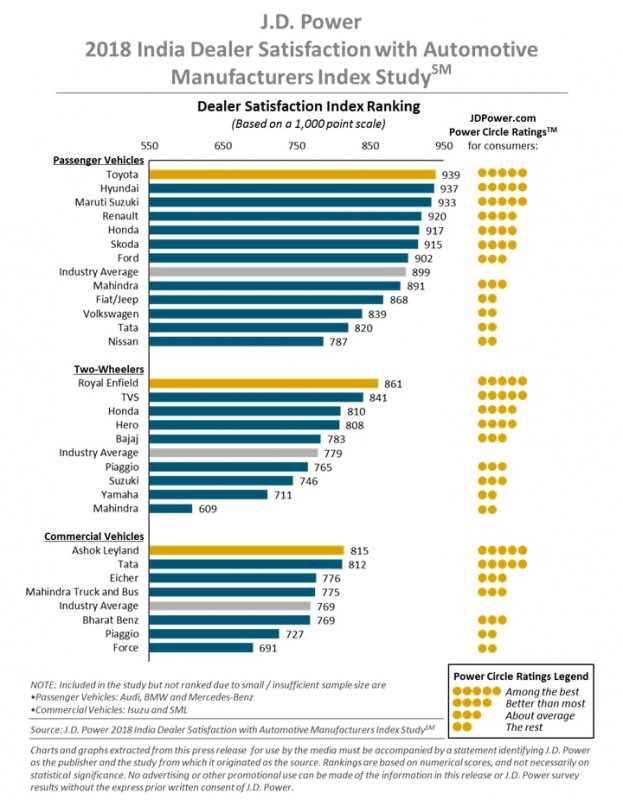

In the passenger-vehicle segment, Toyota (939) ranks highest in dealer satisfaction for the eighth consecutive year, performing particularly well across all factors. Hyundai ranks second with a score of 937, followed by Maruti Suzuki with a score of 933.

Royal Enfield, with a score 861, ranks highest in dealer satisfaction among manufacturers of two-wheelers, followed by TVS at 841. Honda ranks third with 810.

In the commercial vehicle segment, Ashok Leyland ranks highest in dealer satisfaction with a score of 815. Tata ranks second with 812, followed by Eicher with 776.

Now in its eighth year, the India DSWAMI Study measures dealer satisfaction with vehicle manufacturers or importers in India and identifies dealer attitudes regarding the automotive retail business. Overall dealer satisfaction is determined by examining nine factors (in order of importance): sales team; marketing and sales activities; support from the manufacturer; product; vehicle ordering and delivery; training; warranty claims; after-sales team; and parts.

The 2018 study is based on responses from 2,472 dealer principals or dealership general managers located in more than 200 cities throughout India. The study was conducted in association with the Federation of Automobile Dealers Associations (FADA) and was fielded from January through March 2018.

About J.D. Power in the Asia Pacific Region

J.D. Power has offices in Singapore, Bangkok, Beijing, Shanghai and Tokyo that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the five offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. Information regarding J.D. Power and its products can be accessed through the internet at india.jdpower.com.

About J.D. Power and Advertising/Promotional Rules About J.D. Power and our Advertising/Promotional Rules | J.D. Power

J.D. Power’s 2017 India Sales Satisfaction Index StudySM showed that during the past five years, vehicle owners who are 30 years or younger have been using traditional outlets far less often as their information source —notably with declines in television (45% in 2012 vs. 24% in 2017) and newspapers/magazines (53% in 2012 vs. 20% in 2017)—while shopping online for a vehicle has increased by 28 percentage points (28% in 2012 vs. 56% in 2017) during the same period.

“We are increasingly finding that shoppers, particularly in the younger age bracket, are using the internet as their chosen channel to search for product specifications, pricing and promotional offers, reviews and evaluations,” said Shantanu Nandi Majumdar, Regional Director, Automotive Practice at J.D. Power Singapore. “This consumer preference demonstrates how crucial it is for dealers—with the support of their OEMs—to develop their digital strategy to enhance interaction with potential buyers.”

The study finds that nearly 60% of passenger-vehicle dealerships expect that more new-car buyers will purchase their vehicles online instead of from traditional dealer showrooms. This proportion has increased by 14 percentage points since 2016 (43% in 2016 vs. 57% in 2018). Interestingly, the opinion of two-wheeler and commercial vehicles dealerships regarding the possible shift to online sales is divided, with only four in 10 dealerships forecasting such a scenario in the future.

“Passenger-vehicle dealers today are not only interacting digitally with their customers and offering test drives at home, but also working alongside manufacturers to bring the digital showroom into their customers’ homes. The need for customers to visit a showroom to merely see the vehicle or to make enquiries may not be necessary in the future as digital solutions, such as augmented reality or dynamic virtual test drives, will enhance convenience and transparency in the buying process,” added Majumdar.

The following are additional key findings of the study:

Expectations for another profitable financial year: Among the passenger-vehicle dealers surveyed, 63% expect a profitable financial year, which is the highest since 2013. More than half of two-wheeler and commercial vehicle dealers also expect a profitable year, which is higher than in 2017, when two-wheeler and commercial vehicle dealers were first surveyed in the study. Approximately, six in 10 dealers across the three segments expect their profits to be better in 2018 than in 2017.

Retaining manpower proving to be a challenge: Dealers, across the three vehicle segments, continue to have challenges in retaining manpower, with nearly one-fourth of their employees in sales, after-sales service as well as technicians leaving the dealership every year.

Study Rankings

In the passenger-vehicle segment, Toyota (939) ranks highest in dealer satisfaction for the eighth consecutive year, performing particularly well across all factors. Hyundai ranks second with a score of 937, followed by Maruti Suzuki with a score of 933.

Royal Enfield, with a score 861, ranks highest in dealer satisfaction among manufacturers of two-wheelers, followed by TVS at 841. Honda ranks third with 810.

In the commercial vehicle segment, Ashok Leyland ranks highest in dealer satisfaction with a score of 815. Tata ranks second with 812, followed by Eicher with 776.

Now in its eighth year, the India DSWAMI Study measures dealer satisfaction with vehicle manufacturers or importers in India and identifies dealer attitudes regarding the automotive retail business. Overall dealer satisfaction is determined by examining nine factors (in order of importance): sales team; marketing and sales activities; support from the manufacturer; product; vehicle ordering and delivery; training; warranty claims; after-sales team; and parts.

The 2018 study is based on responses from 2,472 dealer principals or dealership general managers located in more than 200 cities throughout India. The study was conducted in association with the Federation of Automobile Dealers Associations (FADA) and was fielded from January through March 2018.

About J.D. Power in the Asia Pacific Region

J.D. Power has offices in Singapore, Bangkok, Beijing, Shanghai and Tokyo that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the five offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. Information regarding J.D. Power and its products can be accessed through the internet at india.jdpower.com.

About J.D. Power and Advertising/Promotional Rules About J.D. Power and our Advertising/Promotional Rules | J.D. Power

Akash