Thread Starter

#1

Domestic tailwinds and emerging export markets to offset any adverse impact of Sri Lanka’s proposed plans to restrict three-wheeler imports: ICRA

October 25, 2017: The recent indication by the Sri Lankan Transport Ministry, to restrict the import of three-wheelers (3W) into the country due to increasing accidents rate and traffic congestion, if implemented may impact India’s 3Ws exports. With a 14% share in overall exports, the importance of Sri Lanka as a 3Ws market cannot be undermined. However the extent of impact in the near term on the domestic industry is expected to be limited, says an ICRA note due to domestic tailwinds and recovery in some of the other export markets. This will help 3Ws OEMs to offset the impact of likely restrictions from Sri Lanka. This is borne out by the fact that the dependence on Sri Lankan market has reduced over the years as OEMs have successfully forayed into many of the African and Latin American markets.

Giving more insights, Mr. Subrata Ray, Sr. Group Vice President, Corporate Sector ratings, ICRA says, “The opening up of 3W market in key states along with replacement-driven demand is likely to drive healthy sales in the near-term, which will help offset the adverse impact of Sri Lanka’s potential restrictions. Furthermore, on the exports front, as Sri Lanka’s share in overall exports pie has reduced from 30% (in FY 2016) to 14% (in FY 2017), countries such as Nigeria and Egypt have emerged as bigger export markets for Indian OEMs.”

The domestic market, which witnessed subdued demand trends (down 5% in FY 2017), is reflecting a positive outlook. This has been driven by factors like discontinuation of cap on permits (for 3Ws) by major states like Maharashtra and Gujarat, release of fresh permits by Delhi Government and replacement demand from Karnataka following Government’s decision to convert all vehicles to four stroke engine and ban diesel vehicles in Bengaluru. As a result of these developments, the domestic 3W sales have witnessed sharp recovery over the past few months and witnessed highest ever domestic sales volumes of 61,680 units in September 2017.

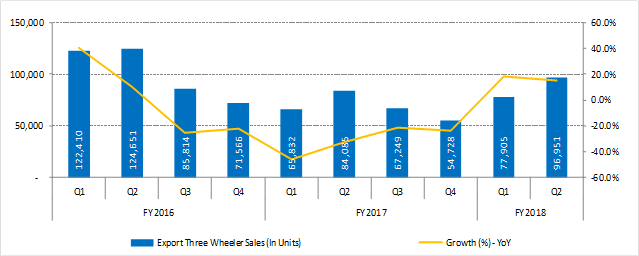

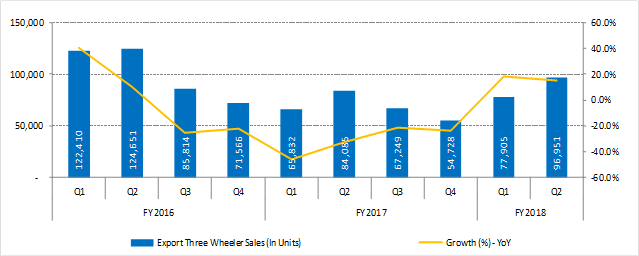

As for exports, India ranks amongst the leading exporter of 3W globally with export sales of over ~272,000 units in FY 2017. Till FY 2016, India’s 3W exports have grown at a CAGR of 12% (in unit sales) over the past decade driven by a confluence of factors including rising demand for last-mile transportation from developing countries with relatively under-developed public transport system, increasing acceptance of 3Ws over four wheelers for commercial transportation and growing focus of Indian OEMs in scaling up presence in markets within South Asia, Africa and Latin America.

Sri Lanka is one of the key export markets for Indian OEMs but over the past few years, its share has declined because of sharp reduction in demand (owing to increase in local taxes) and increasing focus of OEMs to foray into the African and Latin American markets. As a result, Sri Lanka’s share in overall exports pie has reduced in comparison to other markets like Nigeria and Egypt.

“Going forward, continuing political and economic challenges in some of the key importing nations, which were accompanied by sharp currency devaluation and often the inability to repatriate currency, may pose some concerns for 3W OEMs. However the overall outlook appears positive as domestic sales have started inching upwards, over 15% growth in H1FY 2018, driven by pent-up demand and opening up of permits in select states and; a 19% growth in 3W exports in H1 FY 2018 driven by rise in sales to Bangladesh and Egypt,” adds Mr. Ray.

Giving more insights, Mr. Subrata Ray, Sr. Group Vice President, Corporate Sector ratings, ICRA says, “The opening up of 3W market in key states along with replacement-driven demand is likely to drive healthy sales in the near-term, which will help offset the adverse impact of Sri Lanka’s potential restrictions. Furthermore, on the exports front, as Sri Lanka’s share in overall exports pie has reduced from 30% (in FY 2016) to 14% (in FY 2017), countries such as Nigeria and Egypt have emerged as bigger export markets for Indian OEMs.”

The domestic market, which witnessed subdued demand trends (down 5% in FY 2017), is reflecting a positive outlook. This has been driven by factors like discontinuation of cap on permits (for 3Ws) by major states like Maharashtra and Gujarat, release of fresh permits by Delhi Government and replacement demand from Karnataka following Government’s decision to convert all vehicles to four stroke engine and ban diesel vehicles in Bengaluru. As a result of these developments, the domestic 3W sales have witnessed sharp recovery over the past few months and witnessed highest ever domestic sales volumes of 61,680 units in September 2017.

As for exports, India ranks amongst the leading exporter of 3W globally with export sales of over ~272,000 units in FY 2017. Till FY 2016, India’s 3W exports have grown at a CAGR of 12% (in unit sales) over the past decade driven by a confluence of factors including rising demand for last-mile transportation from developing countries with relatively under-developed public transport system, increasing acceptance of 3Ws over four wheelers for commercial transportation and growing focus of Indian OEMs in scaling up presence in markets within South Asia, Africa and Latin America.

Sri Lanka is one of the key export markets for Indian OEMs but over the past few years, its share has declined because of sharp reduction in demand (owing to increase in local taxes) and increasing focus of OEMs to foray into the African and Latin American markets. As a result, Sri Lanka’s share in overall exports pie has reduced in comparison to other markets like Nigeria and Egypt.

“Going forward, continuing political and economic challenges in some of the key importing nations, which were accompanied by sharp currency devaluation and often the inability to repatriate currency, may pose some concerns for 3W OEMs. However the overall outlook appears positive as domestic sales have started inching upwards, over 15% growth in H1FY 2018, driven by pent-up demand and opening up of permits in select states and; a 19% growth in 3W exports in H1 FY 2018 driven by rise in sales to Bangladesh and Egypt,” adds Mr. Ray.

Akash